Are you curious about the inner workings of your crypto wallet and how it securely manages your digital assets? This article dives deep into the crucial role of blockchain technology in powering cryptocurrency wallets. We’ll explore how blockchain’s decentralized nature ensures security and transparency, examining the various types of crypto wallets and their underlying blockchain mechanisms. Learn how blockchain provides the foundation for trust and efficiency in the world of digital currencies, safeguarding your crypto investments. Prepare to gain a comprehensive understanding of the vital connection between blockchain and your crypto wallet!

What is Blockchain Technology?

At its core, blockchain is a decentralized, distributed, and public digital ledger. Think of it as a shared, constantly updated spreadsheet that everyone can access but no single person controls.

Each “page” in this spreadsheet is called a block. These blocks contain verified transactions, which are grouped together and chained sequentially using cryptography. This chaining ensures the security and immutability of the data.

The decentralized nature means no single entity (like a bank or government) manages the blockchain. Instead, it’s maintained by a network of computers (nodes) all over the world, making it highly resistant to censorship and single points of failure.

Cryptographic hashing ensures the integrity of the blockchain. Any attempt to alter a past block would be immediately detected because it would change the hash, breaking the chain. This makes blockchains incredibly secure and transparent.

This technology’s inherent security, transparency, and decentralization are crucial for the function of crypto wallets and the broader cryptocurrency ecosystem.

How Blockchain Secures Crypto Wallets

Blockchain technology is the foundation of cryptocurrency security. It acts as a decentralized, immutable ledger recording all transactions. This means every cryptocurrency transaction is verified and added to the blockchain, making it incredibly difficult to alter or reverse.

This inherent security translates directly to the security of your crypto wallet. Your private keys, essential for accessing your funds, aren’t stored in a single, vulnerable location. Instead, they’re secured through cryptographic techniques and the blockchain’s distributed nature. Even if one part of the network is compromised, the rest of the blockchain remains intact, protecting your assets.

Furthermore, the transparency of the blockchain provides an additional layer of security. All transactions are publicly viewable (though user identities remain pseudonymous), enabling scrutiny and detection of any fraudulent activity. This public audit trail deters malicious actors and increases accountability.

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can further enhance security. They automate transactions and enforce pre-defined rules, minimizing the risk of human error or manipulation.

In essence, blockchain’s decentralized, transparent, and immutable nature makes it a robust and secure environment for managing and protecting cryptocurrency within wallets. This inherent security is a crucial element that sets cryptocurrencies apart from traditional financial systems.

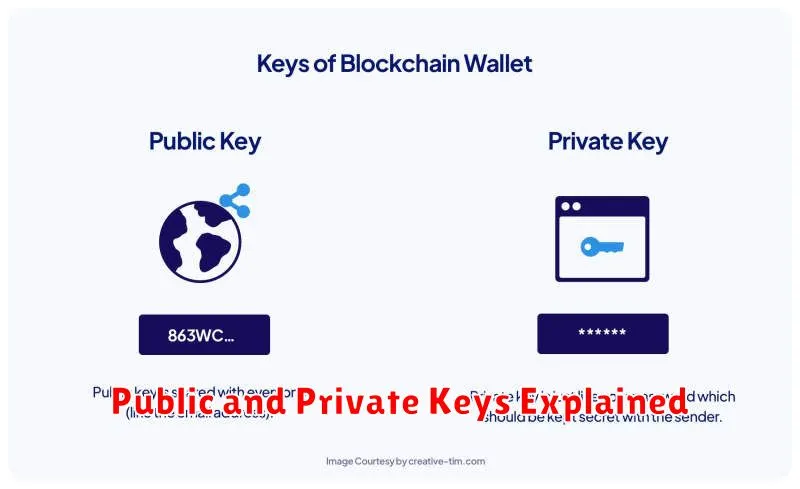

Public and Private Keys Explained

Understanding public and private keys is fundamental to grasping how crypto wallets and blockchain technology work. These keys are the foundation of secure cryptocurrency transactions.

Your private key is a secret, randomly generated string of characters. It’s like your password for your crypto wallet. Never share your private key with anyone. Losing it means losing access to your cryptocurrency forever.

Your public key, on the other hand, is derived from your private key through cryptographic algorithms. It’s a unique identifier, akin to your bank account number. You can freely share your public key with others; they need it to send you cryptocurrency.

The magic lies in the one-way function: It’s easy to generate a public key from a private key, but computationally impossible to derive the private key from the public key. This cryptographic security ensures that only you can access your cryptocurrency using your private key.

In essence, the public key acts as your crypto address, allowing others to send you funds. The private key allows you to authorize the spending of those funds and sign transactions on the blockchain. Maintaining the secrecy of your private key is paramount to your financial security in the crypto world.

The Importance of Decentralization

Decentralization is a cornerstone of blockchain technology and a key reason why crypto wallets are gaining popularity. Traditional financial systems are centralized, meaning they rely on a single point of control, like a bank. This creates vulnerabilities to censorship, single points of failure, and manipulation.

Decentralized systems, on the other hand, distribute control across a network. In the context of crypto wallets, this means your funds are not held by a single entity. Instead, your private keys, which grant access to your cryptocurrency, are secured by you, providing enhanced security and control.

This absence of a central authority also means greater resilience. A single point of failure, such as a bank being hacked, cannot compromise the entire system. The distributed nature of blockchain ensures the network continues to operate even if some parts are compromised, thereby making it more robust.

Furthermore, decentralization fosters greater transparency and immutability. All transactions are recorded on the public blockchain, creating a transparent and auditable history. This makes it difficult to alter or delete transaction records, increasing trust and security.

In essence, decentralization is not just a technical feature of blockchain-based crypto wallets; it’s a fundamental principle that addresses critical weaknesses found in traditional financial systems, offering enhanced security, control, transparency, and resilience to users.

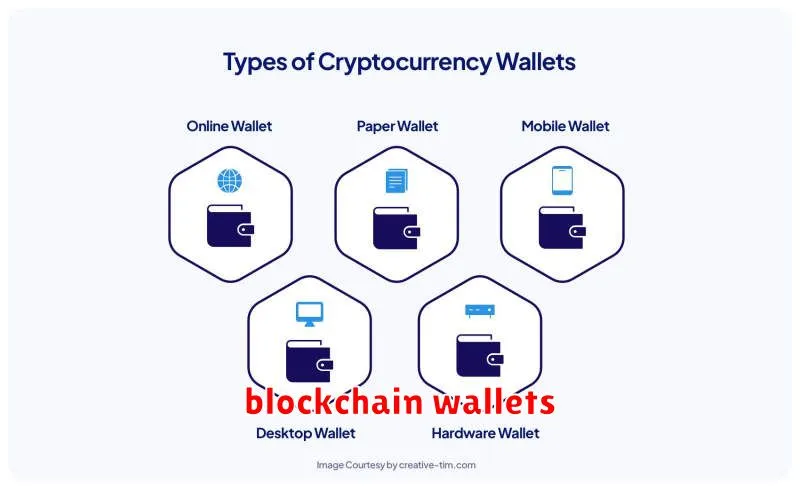

Types of Blockchain Wallets

Choosing the right blockchain wallet is crucial for securely managing your cryptocurrency. Different wallets cater to varying needs and levels of technical expertise. Understanding the key types is essential before selecting one.

Software wallets are applications installed on your computer or mobile device. These offer convenience and accessibility, but security relies on the device’s overall security. Examples include desktop wallets like Exodus and mobile wallets like Trust Wallet. The level of security varies greatly, depending on features like hardware security modules (HSMs) and multi-signature options.

Hardware wallets are physical devices specifically designed for storing cryptocurrency private keys offline. They are considered the most secure option because they isolate your keys from potential online threats. Examples include Ledger and Trezor. While offering superior security, they tend to be more expensive and less convenient than software wallets.

Web wallets are accessed via a web browser. They are convenient for quick transactions, but they pose a higher security risk compared to other options as they are vulnerable to online attacks. Your keys are held by a third party, so you have less control over your assets. Examples include exchanges such as Coinbase.

Paper wallets are essentially printed QR codes containing your public and private keys. They offer strong security if stored safely offline, but they are inconvenient and vulnerable to physical damage or loss. It is vital to create them carefully, as errors can lead to irretrievable loss of funds.

Finally, there are hardware wallets integrated into other devices, such as certain smartphones or specialized smart cards. These offer a balance of security and convenience. The selection of these types of wallets depend on their specific security features and how well integrated they are.

The best type of wallet depends on your individual needs, balancing convenience with security. Consider your technical skills, risk tolerance, and the amount of cryptocurrency you plan to store when making your choice.

Future Trends in Blockchain Wallets

The future of blockchain wallets is bright, promising enhanced security, usability, and functionality. Several key trends are shaping this evolution.

Improved User Experience (UX): Wallets will become significantly more user-friendly, moving away from complex interfaces and technical jargon. Expect simpler onboarding processes, intuitive navigation, and support for multiple cryptocurrencies within a single, unified platform.

Enhanced Security Features: Biometric authentication, multi-factor authentication (MFA), and hardware security modules (HSMs) will become increasingly prevalent, offering robust protection against theft and unauthorized access. Advancements in zero-knowledge proofs will further enhance privacy without sacrificing security.

Decentralized Finance (DeFi) Integration: Wallets will seamlessly integrate with DeFi platforms, enabling users to access a wide range of services directly from their wallets, including lending, borrowing, staking, and trading. This will create a more holistic and convenient cryptocurrency experience.

Cross-Chain Interoperability: The ability to manage multiple cryptocurrencies across different blockchains within a single wallet is crucial. Future wallets will streamline this process, eliminating the need for separate wallets for each blockchain.

Hardware Wallet Advancements: Hardware wallets will see improvements in both security and usability, potentially incorporating features like built-in screens, improved user interfaces, and enhanced security chips.

AI-Powered Features: Artificial intelligence could play a significant role in future wallets, offering features like automated portfolio management, fraud detection, and personalized financial advice.

Social Recovery Mechanisms: These will allow users to regain access to their wallets even if they lose their private keys, by relying on trusted contacts for recovery. This addresses a major pain point for cryptocurrency users.

These trends highlight a future where blockchain wallets are not just secure storage solutions, but intuitive and powerful financial tools, accessible to a wider audience and integrated deeply into the evolving landscape of the digital economy.

Integrating Blockchain with Hardware Wallets

Hardware wallets offer a high level of security for cryptocurrency storage, and their integration with the blockchain is crucial to their functionality. The blockchain itself acts as the public ledger, recording all transactions. Hardware wallets interact with the blockchain through a secure element, a specialized chip that protects private keys from external threats.

When you send cryptocurrency from a hardware wallet, the wallet communicates with the blockchain network using a signed transaction. This transaction, created and signed within the secure element, contains all the necessary information – the sender’s address, the recipient’s address, the amount, and a unique digital signature. This signature verifies your ownership of the funds and prevents unauthorized access.

The integration process is typically seamless for the user. After initiating a transaction on the wallet’s interface, the hardware wallet displays the details for verification before signing and broadcasting it to the blockchain. The transaction is then verified by the blockchain network through consensus mechanisms (like Proof-of-Work or Proof-of-Stake), ensuring its legitimacy and adding it permanently to the immutable record.

The strength of this integration lies in the separation of private keys from the external environment. Even if a hardware wallet is compromised, the private keys remain safe within the secure element, making it incredibly difficult for attackers to access and spend your cryptocurrency.

In summary, the integration of blockchain technology with hardware wallets provides a robust and secure method for managing and transacting cryptocurrency, combining the decentralized nature of blockchain with the enhanced security of dedicated hardware.

Blockchain’s Role in Reducing Fraud

One of the most significant advantages of blockchain technology in crypto wallets is its inherent ability to reduce fraud. Transparency is key; every transaction is recorded on a public, immutable ledger, making it extremely difficult to alter or erase records. This transparency discourages fraudulent activities as all actions are visible to all participants.

The decentralized nature of blockchain further enhances security. Unlike traditional systems reliant on central authorities, blockchain eliminates single points of failure. This makes it significantly harder for hackers to compromise the entire system and perpetrate large-scale fraud. Instead of targeting a single server, they’d have to compromise countless nodes, a practically impossible task.

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate transactions and eliminate the need for intermediaries, which are often vulnerable points for fraud. This automation and reduction of human intervention minimizes the risk of human error or malicious intent.

The cryptographic security features embedded in blockchain technology protect transactions with digital signatures and encryption. This ensures the authenticity and integrity of data, making it incredibly difficult for fraudulent transactions to go undetected. The combination of these features creates a robust and secure environment for crypto transactions, significantly minimizing the risk of fraud.