Choosing the right crypto exchange can feel overwhelming, with so many platforms vying for your attention. But finding the best crypto exchange for your needs is crucial for a secure and profitable trading experience. This guide will help you navigate the complexities of selecting a platform, considering factors like fees, security, available cryptocurrencies, and user experience, so you can confidently start your cryptocurrency trading journey. Learn how to compare top crypto exchanges and make an informed decision that aligns with your specific trading goals and risk tolerance.

Understanding the Different Types of Crypto Exchanges

Choosing the right crypto exchange is crucial for a smooth and secure trading experience. Understanding the different types available is the first step. Centralized Exchanges (CEXs) are the most common, acting as intermediaries holding your funds. They offer a wide range of features and generally have higher liquidity but also carry higher security risks.

Decentralized Exchanges (DEXs), on the other hand, operate without a central authority. This means your funds remain in your control throughout the trading process. DEXs offer greater privacy and security but often have lower liquidity and can be more complex to use. Peer-to-peer (P2P) exchanges allow you to directly trade with other users, eliminating the need for an intermediary. This can offer more flexibility but usually involves a higher level of risk due to counterparty risk.

Another key distinction lies in the types of cryptocurrencies offered. Some exchanges specialize in specific crypto assets, while others provide a broader selection. Consider your investment strategy when choosing an exchange; if you’re focusing on a niche area, a specialized exchange might be better suited. Finally, hybrid exchanges combine features of CEXs and DEXs, aiming to provide the best of both worlds. They offer a balance between security, liquidity, and user experience. Understanding these different types will empower you to make an informed decision.

Factors to Consider: Security

Choosing a secure crypto exchange is paramount. Your funds are at stake, so prioritize platforms with a strong track record. Look for exchanges that utilize robust security measures, including two-factor authentication (2FA), cold storage for the majority of their assets, and regular security audits.

Investigate the exchange’s history. Have they experienced any significant security breaches in the past? A clean history is a strong indicator of a reliable platform. Transparency is also crucial; look for exchanges that openly communicate their security protocols and any incidents that may have occurred.

Consider the exchange’s insurance policies and reserve holdings. While no system is foolproof, a well-insured exchange can mitigate potential losses in the event of a security breach. Transparency about reserve holdings assures users that the exchange holds sufficient assets to cover customer balances.

Pay attention to the platform’s compliance certifications and regulatory oversight. Exchanges adhering to industry best practices and subject to regulatory scrutiny often demonstrate a higher commitment to security.

Finally, don’t underestimate the importance of user reviews. While not definitive proof, consistently negative feedback regarding security can be a warning sign. Look for mentions of security issues raised by other users.

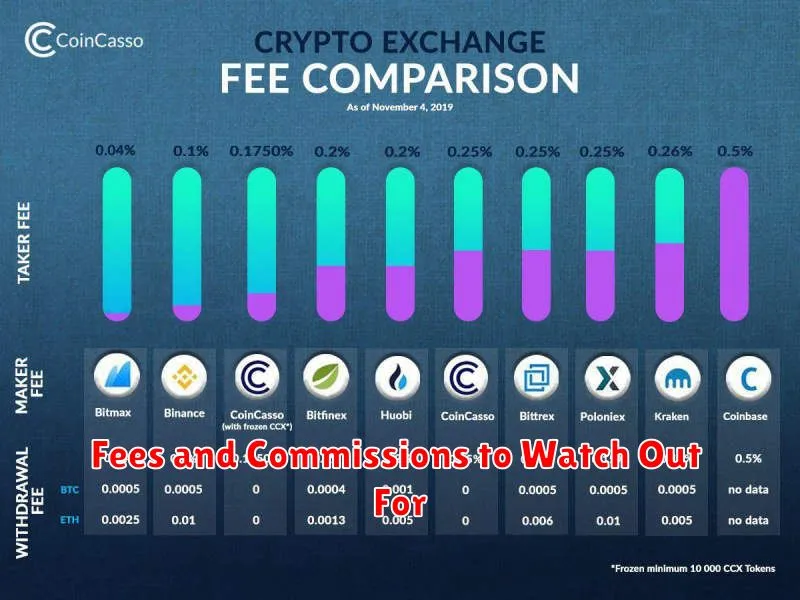

Fees and Commissions to Watch Out For

Choosing the right crypto exchange involves carefully considering the various fees and commissions involved. These can significantly impact your overall profitability, so it’s crucial to understand what you’re paying for.

Trading Fees are perhaps the most obvious. These are charged per trade and vary widely depending on the exchange and the trading pair. Some exchanges use a maker-taker fee structure, rewarding users who add liquidity to the order book (makers) with lower fees and charging higher fees to those who remove liquidity (takers). Others use a flat fee structure, charging the same fee regardless of order type.

Withdrawal Fees are charges incurred when transferring your cryptocurrencies off the exchange to your personal wallet. These fees depend on the cryptocurrency and the network used for the transfer. Be sure to check the specific fees for each coin you intend to withdraw.

Deposit Fees are less common but some exchanges may charge fees when you deposit funds, particularly with fiat currencies. Always check the fee schedule before depositing.

Inactivity Fees are another potential hidden cost. Some exchanges charge fees if your account remains inactive for a prolonged period. This is less common but worth being aware of.

Beyond these core fees, some exchanges may have additional fees associated with specific services, like staking or margin trading. Carefully review the complete fee schedule on the exchange’s website before signing up. Comparing fees across several exchanges will help you identify the most cost-effective option for your trading style and volume.

Ease of Use and User Interface

Choosing a crypto exchange often hinges on its ease of use and user interface (UI). A clunky, confusing platform can quickly frustrate even experienced traders, while a well-designed interface makes navigating the exchange a breeze.

Consider the following factors when assessing the UI/UX:

- Intuitive Navigation: Can you easily find what you need? Are the menus clear and well-organized?

- Order Placement: Is placing buy and sell orders straightforward? Are the order types (market, limit, etc.) easily accessible and understandable?

- Mobile App: Does the exchange offer a mobile app that mirrors the desktop experience in terms of functionality and ease of use? A good mobile app is crucial for convenient trading on the go.

- Account Management: Is managing your account (depositing, withdrawing, security settings) simple and intuitive?

- Educational Resources: Does the exchange provide helpful tutorials, FAQs, or other resources to assist new users?

Before committing to an exchange, it’s highly recommended to try out the platform’s demo or test environment (if available) to get a feel for its interface and functionality. Don’t underestimate the importance of a user-friendly experience – it can significantly impact your trading efficiency and overall satisfaction.

Availability of Cryptocurrencies on the Platform

Choosing a crypto exchange requires careful consideration of the cryptocurrencies it offers. Different exchanges list varying numbers and types of digital assets. Some platforms focus on a wide selection, including major cryptocurrencies like Bitcoin and Ethereum, along with numerous altcoins and lesser-known tokens. Others might specialize in a smaller, curated list, often prioritizing established or high-demand assets.

Consider your investment strategy. If you plan to diversify across many cryptocurrencies, a platform with a large selection is crucial. If you’re focused on a few specific assets, a smaller exchange might suffice. However, ensure the exchange lists the specific cryptocurrencies you intend to trade. Check the platform’s website for a complete list of available assets; this information is usually readily available.

Furthermore, look beyond just the quantity. Check the trading volume for each cryptocurrency. Higher volume generally means better liquidity, allowing you to buy or sell quickly and efficiently without significantly impacting the price. A platform with high trading volume for your chosen cryptocurrencies is generally preferable.

Finally, be aware that the availability of cryptocurrencies can change. Exchanges regularly add and delist assets based on market demand and regulatory considerations. It’s wise to monitor the platform you choose for updates and changes to their listings.

Liquidity and Volume

Liquidity refers to how easily you can buy or sell a cryptocurrency without significantly impacting its price. High liquidity means you can execute trades quickly at the current market price, while low liquidity can lead to slippage (buying or selling at a less favorable price than expected).

Volume represents the total amount of cryptocurrency traded within a specific timeframe (e.g., 24 hours). High volume generally indicates a more liquid market, as more buyers and sellers are actively participating. However, high volume doesn’t guarantee liquidity; a highly volatile asset can have high volume but still experience significant price swings during trades.

When choosing an exchange, prioritize those with high liquidity and volume, especially for the cryptocurrencies you intend to trade. Check the exchange’s website or use third-party resources to compare trading volumes and depth of order books across different platforms. A deeper order book (more buy and sell orders at various price points) typically signifies better liquidity.

Consider the specific cryptocurrencies you’ll be trading. A highly liquid exchange for Bitcoin might not be as liquid for smaller, less-traded altcoins. Research the volume for your preferred assets on different exchanges before making a decision.

In short, liquidity and volume are crucial factors impacting your trading experience. High liquidity ensures smooth, efficient trades, while high volume often correlates with better liquidity. Always check these metrics before selecting a cryptocurrency exchange.

Customer Support and Resources

Choosing a crypto exchange also means considering its customer support and available resources. A robust support system is crucial, especially given the volatile nature of the cryptocurrency market.

Look for exchanges that offer multiple support channels, such as email, phone, and live chat. The availability of a comprehensive FAQ section and a helpful knowledge base can also significantly reduce the need for direct support contact.

Consider the response time and quality of support offered. Read reviews to gauge the experiences of other users. A responsive and helpful support team can make all the difference when dealing with issues like account security, transaction problems, or general inquiries.

Community support is also a valuable asset. An active and engaged community forum can provide a platform for users to ask questions, share knowledge, and troubleshoot problems together. This can be particularly beneficial for less experienced cryptocurrency investors.

Ultimately, prioritizing accessible and effective customer support ensures a smoother and more secure trading experience. Don’t underestimate the importance of readily available resources and responsive assistance when navigating the complexities of the cryptocurrency world.

Comparing Top Crypto Exchanges

Choosing the right cryptocurrency exchange is crucial for a smooth and secure trading experience. Several top contenders dominate the market, each with its strengths and weaknesses. This comparison focuses on key factors to help you make an informed decision.

Binance, a global leader, boasts a vast selection of cryptocurrencies, low trading fees, and a user-friendly interface (though its reputation has faced scrutiny in recent times). However, its regulatory compliance varies across regions. Coinbase, a more regulated exchange, prioritizes security and user experience, particularly appealing to beginners. Its fees are generally higher than Binance’s, and the cryptocurrency selection is slightly more limited.

Kraken positions itself as a secure and reliable platform, with a strong focus on regulatory compliance and advanced trading tools. It caters to more experienced traders but might be less intuitive for beginners. KuCoin presents a balance between a large cryptocurrency selection and competitive fees, often appealing to those seeking more obscure tokens and DeFi opportunities. However, less robust regulatory oversight should be considered.

When comparing, consider these critical factors: security measures (two-factor authentication, cold storage), fees (trading, deposit, withdrawal), available cryptocurrencies, user interface and ease of navigation, regulatory compliance in your region, and customer support responsiveness. Research each exchange thoroughly before investing any funds.

Remember, the “best” exchange is subjective and depends on your individual needs and risk tolerance. Thorough research and careful consideration of these factors will guide you towards the platform that best suits your cryptocurrency trading strategy.

How to Test an Exchange with Small Transactions

Before committing significant funds to any crypto exchange, it’s crucial to test the platform with small transactions. This allows you to assess its functionality and reliability without risking substantial losses.

Start by depositing a small amount of cryptocurrency or fiat currency. A few dollars or a fraction of a single coin is sufficient for initial testing. This allows you to familiarize yourself with the deposit process and any associated fees.

Next, place some small trades. Buy and sell a small quantity of a cryptocurrency you’re comfortable with. Pay close attention to the order execution speed, any discrepancies between the displayed price and the actual execution price (slippage), and the overall user experience.

After completing your trades, withdraw your funds. This tests the withdrawal process, fees, and processing times. Compare the actual withdrawal amount to what you expected, accounting for any fees.

Throughout the process, note the exchange’s security features, like two-factor authentication (2FA). Check the website for security certifications and reviews to gauge its overall security posture.

By thoroughly testing with small transactions, you can identify potential issues – such as high fees, slow transaction speeds, or unreliable security – before risking larger investments. This methodical approach helps you choose a reliable and user-friendly exchange that best meets your needs.