Looking for ways to make passive income? Tired of the 9-to-5 grind? Then you need to explore the exciting world of crypto lending! This guide will show you how to earn passive income with crypto lending, explaining the process step-by-step, highlighting the best platforms, and addressing potential risks. Learn how to generate consistent returns on your cryptocurrency holdings, even while you sleep, and unlock the potential of passive income streams in the dynamic crypto market. Discover the secrets to building wealth through crypto lending strategies and start earning today!

What is Crypto Lending?

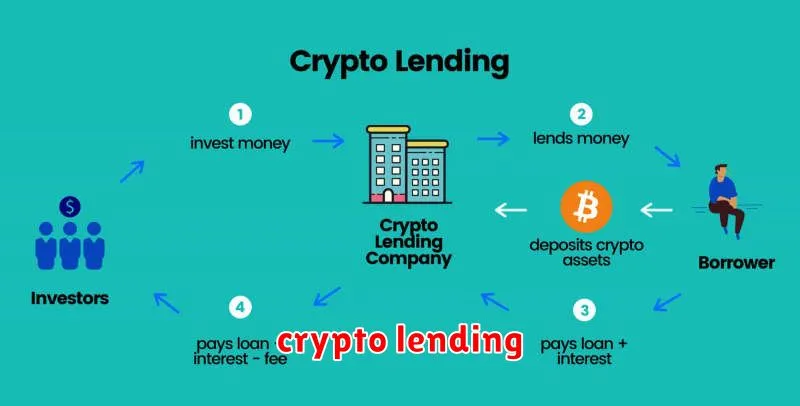

Crypto lending is a process where you lend your cryptocurrencies to other users or platforms in exchange for interest. Think of it like putting your money in a high-yield savings account, but with crypto.

Instead of traditional banks, you’re lending to decentralized finance (DeFi) platforms or centralized exchanges. These platforms then use your crypto for various purposes, such as trading, providing liquidity, or lending to other users.

The interest rates you earn vary depending on several factors including the cryptocurrency you lend, the platform you use, and the length of the lending period. Some platforms offer daily, weekly, or monthly interest payments.

It’s important to note that crypto lending involves risks, including the risk of platform insolvency, smart contract vulnerabilities, and market volatility impacting the value of your crypto. Thorough research and understanding of these risks are crucial before participating.

Best Platforms for Lending: BlockFi

BlockFi is a popular platform for crypto lending, offering competitive interest rates on various cryptocurrencies. It’s known for its user-friendly interface and relatively straightforward process. BlockFi allows you to earn passive income by lending your crypto assets to institutional borrowers. You receive interest payments regularly, typically in the same cryptocurrency you deposited.

One of BlockFi’s key strengths is its regulated status in several jurisdictions, providing a level of security and trust not always found with other lending platforms. However, it’s crucial to understand the risks involved in crypto lending, including the potential for platform insolvency or market volatility affecting your returns. Always carefully review the terms and conditions before lending your cryptocurrency.

BlockFi’s offerings include various accounts, allowing you to choose the level of risk and reward that suits your investment strategy. While interest rates can fluctuate based on market conditions, they generally remain competitive with other major players in the crypto lending space. Remember to diversify your crypto portfolio and not rely solely on a single lending platform.

Before using BlockFi or any crypto lending platform, conduct thorough research, understand the associated risks, and only invest what you can afford to lose. Proper due diligence is paramount when dealing with cryptocurrency investments.

How to Lend Crypto on Aave

Aave is a decentralized finance (DeFi) platform that allows you to lend and borrow cryptocurrencies. Earning passive income through lending on Aave involves depositing your crypto assets into lending pools.

Step 1: Connect your Wallet: First, you need to connect a compatible wallet like MetaMask or WalletConnect to the Aave platform. Ensure you have sufficient funds in your chosen wallet.

Step 2: Choose Your Asset: Select the cryptocurrency you wish to lend from the available options on the Aave platform. The interest rates vary depending on the asset and market demand.

Step 3: Supply Your Crypto: Once you’ve selected your asset, specify the amount you want to lend and confirm the transaction. Aave will then lock your crypto in the corresponding lending pool.

Step 4: Earn Interest: You’ll start earning interest on your supplied crypto immediately. The interest rate is dynamic and fluctuates based on supply and demand. You can check your accrued interest at any time.

Step 5: Withdraw Your Funds: When you want to withdraw your funds, simply redeem your assets from Aave. You’ll receive your principal plus the accumulated interest. Remember to factor in any gas fees.

Important Considerations: Understand the risks involved. While Aave is a popular platform, DeFi lending carries inherent risks including smart contract vulnerabilities and market volatility. Always lend responsibly and only with cryptocurrency you can afford to lose.

Understanding Interest Rates in Crypto Lending

Crypto lending platforms offer interest rates on deposited cryptocurrencies, allowing you to earn passive income. These rates vary significantly based on several factors.

The type of cryptocurrency you lend plays a crucial role. Popular coins like Bitcoin and Ethereum often command lower rates due to higher demand and lower risk. Less established cryptocurrencies may offer higher rates to incentivize lending, but carry a proportionally higher risk.

The lending platform itself influences interest rates. Each platform has its own risk assessment and operational costs, directly impacting the rates they can offer. Compare rates across different platforms to find the best options for your needs.

The term of the loan also impacts interest rates. Shorter-term loans usually have lower interest rates while longer-term loans often provide higher returns but with increased risk. Consider your liquidity needs and risk tolerance when choosing a loan duration.

Market conditions are another key factor. Interest rates fluctuate based on overall market demand for lending and borrowing. Periods of high market volatility may see interest rates change frequently.

Always carefully review the terms and conditions of any lending platform before depositing your cryptocurrencies. Pay close attention to the interest rate offered, the associated fees, and the platform’s security measures to protect your assets. Understanding these factors is crucial to making informed decisions and maximizing your passive income.

Risk Factors in Crypto Lending

Crypto lending, while offering the potential for passive income, carries significant risks. Understanding these risks is crucial before participating.

Smart contract risks are paramount. Bugs or vulnerabilities in the platform’s code could lead to the loss of your funds. Thoroughly research the platform’s security audits and track record before lending.

Platform risk is another major concern. The lending platform itself could become insolvent, be hacked, or face regulatory issues, resulting in the loss of your principal and accrued interest. Diversify your lending across multiple platforms to mitigate this risk.

Market volatility significantly impacts crypto lending. The value of the crypto assets you lend can fluctuate dramatically, potentially resulting in losses if the value drops below the loan’s collateral value. This risk is inherent to the cryptocurrency market itself.

Interest rate risk should also be considered. While higher interest rates offer potentially greater returns, they also often come with increased risk. A sudden drop in interest rates could impact your overall earnings.

Regulatory uncertainty is another key factor. The regulatory landscape for crypto lending is constantly evolving and varies significantly by jurisdiction. Changes in regulations could impact the legality and operation of lending platforms.

Finally, counterparty risk applies if you’re lending directly to borrowers. There’s a risk that the borrower may default on their loan, leaving you with losses. Platforms mitigating this risk through over-collateralization and risk assessments should be prioritized.

Carefully assess your risk tolerance before engaging in crypto lending. Remember that no investment is without risk, and the potential for high rewards often comes with a high degree of risk.

How to Diversify Your Lending Portfolio

Diversification is crucial for mitigating risk in any investment, and crypto lending is no exception. Don’t put all your crypto eggs in one basket! Spreading your investments across various platforms and protocols significantly reduces the impact of a single platform failing or experiencing a downturn.

Consider diversifying by lending to different protocols. Each platform has its own risk profile, interest rates, and security measures. Some are centralized, while others are decentralized. Research thoroughly before choosing where to lend your crypto.

Another aspect of diversification is the variety of cryptocurrencies you lend. Instead of focusing solely on one asset, spread your loans across different coins or tokens. This approach helps to balance potential gains and losses, minimizing the risk associated with the volatility of a single cryptocurrency.

Finally, remember to diversify your lending strategies. Explore options beyond simple lending, such as staking, liquidity provision, or yield farming. Each strategy carries different levels of risk and reward, allowing for a tailored approach to your portfolio’s overall risk tolerance.

By carefully considering these aspects – protocols, cryptocurrencies, and lending strategies – you can create a more robust and resilient crypto lending portfolio that maximizes your passive income potential while minimizing your risk exposure.

The Future of Crypto Lending in DeFi

The future of crypto lending within Decentralized Finance (DeFi) is bright, but also uncertain. Several factors will shape its trajectory.

Increased Institutional Adoption: As more institutional investors enter the space, we can expect to see greater liquidity and more sophisticated lending platforms emerge. This will lead to higher levels of security and potentially lower interest rates for borrowers, while offering potentially higher yields for lenders.

Regulatory Clarity: Clearer regulatory frameworks are crucial for the long-term growth of DeFi lending. Increased regulatory oversight could improve investor confidence, but overly strict regulations could stifle innovation and hinder growth.

Technological Advancements: Innovations like layer-2 scaling solutions and improved smart contract security will play a key role. Faster transaction speeds and enhanced security will attract more users and create a more robust lending ecosystem.

Competition and Consolidation: The DeFi lending space is highly competitive. We’re likely to see consolidation as smaller platforms merge or get acquired by larger players. This could result in fewer but more established and reliable platforms.

Cross-Chain Interoperability: The ability to easily lend and borrow across different blockchains will be a major driver of growth. This will expand the available pool of assets and increase the overall efficiency of the DeFi lending market.

Overall, the future of crypto lending in DeFi is promising, but it will depend on how these factors evolve. A careful balance between innovation, regulation, and security will be key to unlocking the full potential of this exciting space.