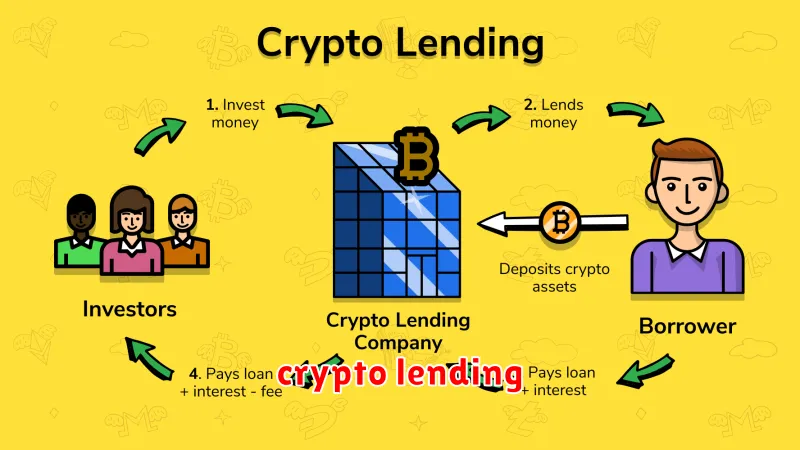

Looking for the best crypto lending platforms in 2024? You’ve come to the right place! This year offers exciting opportunities to earn passive income on your cryptocurrency holdings, but navigating the world of crypto lending can be tricky. We’ve compiled a comprehensive guide to the top platforms, comparing interest rates, security measures, available cryptocurrencies, and more. Discover which platforms offer the best combination of high yields and robust security to help you maximize your returns in 2024. Learn about the risks and rewards of crypto lending and find the perfect platform for your investment strategy.

Nexo

Nexo is a popular choice for crypto lending, offering instant crypto loans with competitive interest rates. They are known for their user-friendly platform and quick loan processing times. Users can borrow against their crypto assets without selling them, providing liquidity without sacrificing ownership.

One of Nexo’s key advantages is its wide range of supported cryptocurrencies, allowing users to utilize various assets as collateral. They also offer a relatively high interest rate on deposited cryptocurrencies, making it attractive for both borrowers and lenders.

However, potential drawbacks include fees associated with loans and the risk involved in lending cryptocurrencies, as with any platform of this type. It’s crucial to understand the terms and conditions before using the platform. Furthermore, regulatory compliance and geographical limitations should be considered.

Overall, Nexo presents a compelling option for individuals looking for a convenient and relatively high-yield crypto lending platform. Nevertheless, thorough research and an understanding of associated risks are essential before engaging with their services.

BlockFi

BlockFi was once a prominent player in the crypto lending space, known for its competitive interest rates and user-friendly platform. However, it filed for bankruptcy in November 2022 due to financial difficulties stemming from the collapse of several major cryptocurrencies and the overall market downturn. As a result, BlockFi is no longer operational and is currently undergoing liquidation proceedings.

While BlockFi offered various services, including interest-bearing accounts and crypto loans, these services are now unavailable. Users with funds on the platform are currently navigating the bankruptcy process to potentially recover their assets. This situation serves as a cautionary tale about the risks involved in crypto lending and the importance of choosing reputable and financially stable platforms.

Therefore, while BlockFi was once considered a viable option, it’s crucial to note its current status as defunct. Investors should thoroughly research and understand the risks associated with any crypto lending platform before entrusting their funds.

Celsius Network

Celsius Network was once a prominent player in the crypto lending space, known for its high interest rates on deposited cryptocurrencies. However, it filed for bankruptcy in July 2022, leaving many users unable to access their funds. This dramatic collapse highlighted the risks associated with crypto lending platforms and serves as a cautionary tale.

While Celsius offered competitive yields, its ultimate failure underscores the importance of understanding the inherent volatility and risks within the cryptocurrency market. The platform’s demise demonstrates that even seemingly stable platforms can face unforeseen challenges, and users should carefully evaluate the financial health and regulatory compliance of any platform before entrusting their assets.

The lack of regulatory oversight in the crypto lending sector contributed to the instability. The Celsius case emphasizes the need for increased regulation and transparency within the industry to protect investors. Before engaging with any crypto lending platform, thorough due diligence is crucial.

In short, while Celsius Network once offered attractive yields, its spectacular failure serves as a stark reminder of the risks involved in crypto lending. Prospective users should prioritize platforms with a strong track record, robust security measures, and a clear regulatory framework.

Aave

Aave is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies. It’s known for its high interest rates on deposits and its wide range of supported assets. Users can earn passive income by lending their cryptocurrencies to others, while borrowers can access funds without going through traditional financial institutions.

One of Aave’s key features is its flash loans. These are short-term, uncollateralized loans that are repaid within a single transaction. This functionality is particularly attractive to sophisticated users and developers for arbitrage and complex DeFi strategies.

Risk management is a critical aspect of using Aave. While it offers high yields, there’s always the risk of losing funds due to market volatility or smart contract vulnerabilities. Users should carefully assess their risk tolerance before participating.

Transparency is a core principle of Aave, with all transactions recorded on the blockchain. This offers a high level of accountability and allows users to easily track their assets and activity. However, understanding the intricacies of decentralized finance and smart contracts is crucial before using the platform.

Aave’s user-friendly interface makes it accessible to both beginners and experienced crypto users, although familiarity with DeFi concepts is beneficial. The platform continuously evolves, adding new features and improving its functionality.

Compound

Compound is a decentralized finance (DeFi) lending platform that allows users to lend and borrow cryptocurrencies. It’s known for its transparency and security, achieved through its reliance on smart contracts on the Ethereum blockchain. Users can earn interest on their deposited assets, while borrowers can access funds at competitive rates.

A key feature of Compound is its algorithmic interest rate system, which adjusts rates based on supply and demand. This dynamic mechanism aims to ensure optimal utilization of funds and balanced interest rates for both lenders and borrowers. The platform supports a range of cryptocurrencies, offering diversification options for users.

While Compound offers high potential returns for lenders, it’s crucial to understand the associated risks. These include smart contract vulnerabilities, market volatility affecting the value of lent assets, and the potential for liquidation of borrowed assets if collateral value falls below a certain threshold. Thorough research and understanding of DeFi risks are essential before using any platform, including Compound.

Ultimately, Compound represents a significant player in the DeFi lending landscape, offering a decentralized and transparent approach to crypto lending. However, users should carefully consider the risks involved before participating.

Binance Lending

Binance Lending offers a range of flexible and fixed-term options for lending your crypto assets. Users can earn passive income by lending various cryptocurrencies, with interest rates varying depending on the asset and the lending term.

Key features often include competitive interest rates, a wide selection of supported cryptocurrencies, and a user-friendly interface accessible through the Binance platform. However, it’s crucial to understand that all lending carries inherent risk, including the risk of fluctuations in cryptocurrency values and potential platform vulnerabilities.

Before participating in Binance Lending, thoroughly review the terms and conditions, understand the associated risks, and only lend assets you can afford to lose. Diversification across different lending platforms and asset classes is also a wise strategy for mitigating risk.

Binance Lending can be a viable option for earning passive income on your crypto holdings, but due diligence and careful risk assessment are paramount.

Crypto.com Earn

Crypto.com Earn is a popular platform offering users the opportunity to earn interest on their cryptocurrency holdings. It provides a range of flexible and fixed-term options, allowing users to choose the best strategy for their needs. Interest rates vary depending on the cryptocurrency and the chosen term.

Key features of Crypto.com Earn include a user-friendly interface, a diverse selection of supported cryptocurrencies, and competitive interest rates. The platform also offers a tiered system, rewarding users with higher interest rates based on their CRO staking levels. This incentivizes users to hold CRO, Crypto.com’s native token.

However, it’s crucial to consider the risks associated with any crypto lending platform. While Crypto.com is a reputable exchange, risks including platform security breaches and market volatility remain. Users should carefully assess their risk tolerance before investing.

Overall, Crypto.com Earn presents a viable option for those seeking to earn passive income on their crypto assets. Its user-friendly platform and competitive rates make it a popular choice, but potential users must understand and manage the inherent risks involved in crypto lending.

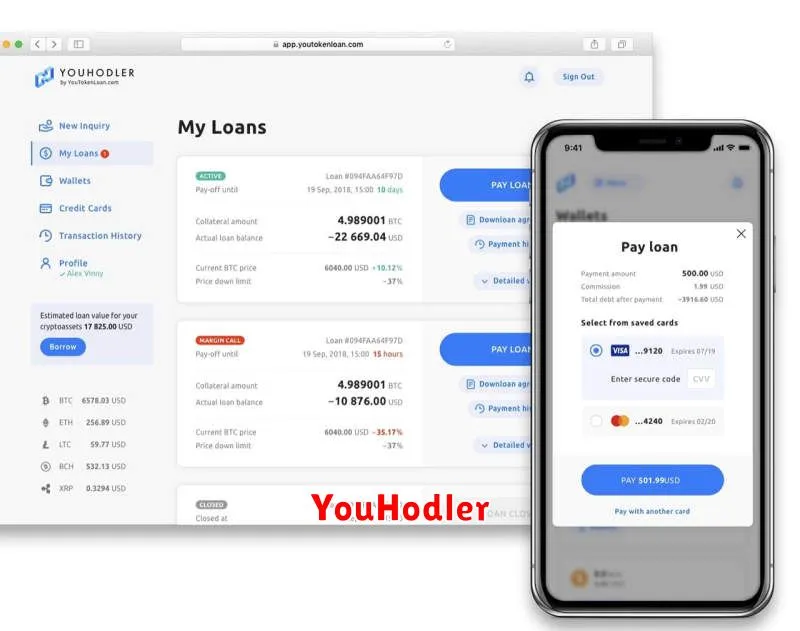

YouHodler

YouHodler stands out as a crypto lending platform offering a unique blend of services. It’s known for its multi-crypto collateralization, allowing users to borrow stablecoins or fiat against a basket of crypto assets. This feature provides greater flexibility compared to platforms that only accept a limited number of cryptocurrencies as collateral.

One of its key strengths is the availability of high loan-to-value (LTV) ratios, enabling users to borrow larger amounts relative to their collateral. However, it’s crucial to remember that higher LTV ratios come with increased risk. YouHodler also provides access to various cryptocurrencies for both borrowing and lending.

While interest rates and fees can vary depending on the market conditions and the chosen assets, they are generally competitive within the crypto lending space. Transparency regarding fees is essential, and users should carefully review the platform’s fee schedule before engaging in any lending or borrowing activities. Always thoroughly research before using any platform, understanding the risks associated with crypto lending.

In summary, YouHodler presents a compelling option for users seeking a platform with flexible collateral options and potentially high LTV ratios. However, users should carefully weigh the risks associated with higher LTV loans and understand the platform’s fee structure before committing funds.

MakerDAO

MakerDAO is a unique decentralized finance (DeFi) platform offering a stablecoin called DAI. Unlike many other platforms, it doesn’t directly offer lending services in the traditional sense. Instead, users can lock up collateral (primarily ETH) in MakerDAO’s smart contracts to mint DAI. This DAI can then be used for various purposes, including lending on other platforms.

Key Feature: MakerDAO’s strength lies in its stability mechanism. The over-collateralization requirement ensures DAI maintains a 1:1 peg with the US dollar. This makes it a very attractive option for those seeking a stable, low-risk asset for borrowing or lending elsewhere. The risk is primarily associated with the price volatility of the collateral used to mint DAI.

How it Works with Lending: While MakerDAO itself isn’t a lending platform, it’s a crucial component within the DeFi ecosystem. Borrowed DAI can be lent out on other platforms, creating a sophisticated lending strategy. This allows users to leverage their crypto assets to earn interest without directly exposing them to lending risks within MakerDAO itself.

Risks to Consider: Smart contract vulnerabilities and the fluctuating price of the collateral assets represent potential risks. A significant drop in the collateral asset’s value could lead to liquidation of user positions.

Venus Protocol

Venus Protocol is a decentralized finance (DeFi) platform built on the Binance Smart Chain (BSC). It’s a prominent player in the crypto lending space, offering users the ability to lend and borrow various cryptocurrencies.

Key features of Venus include its algorithmic stablecoin, VAI, which is pegged to the US dollar and allows users to borrow against their collateral. The platform also boasts a relatively high Annual Percentage Yield (APY) on deposits compared to some other platforms, making it attractive to yield farmers. However, it’s important to note that higher APYs often come with higher risk.

While Venus offers attractive yields, users should be aware of the risks associated with DeFi lending. These include smart contract vulnerabilities, price volatility of underlying assets, and the potential for liquidation if collateral value falls below the loan-to-value (LTV) ratio.

In short, Venus Protocol presents a compelling option for users seeking higher yields in the DeFi lending space. However, thorough research and a good understanding of the risks involved are crucial before participating.