Ready to conquer the exciting world of day trading cryptocurrency? This guide unveils the best strategies for navigating the volatile crypto market and maximizing your profit potential. Learn how to identify profitable trading opportunities, master risk management techniques, and develop a winning day trading cryptocurrency strategy that suits your investment style. Discover the secrets to successful crypto day trading and transform your trading game today! We’ll cover essential topics such as technical analysis, chart patterns, and market sentiment to help you make informed decisions and achieve consistent returns.

What is Day Trading in Cryptocurrency?

Day trading in cryptocurrency involves buying and selling digital assets within a single trading day. Unlike long-term investing, day traders aim to profit from short-term price fluctuations, often closing all positions before the market closes.

This strategy requires active monitoring of the market, quick decision-making, and a solid understanding of technical analysis. Day traders rely on charts, indicators, and news events to identify potential trading opportunities, aiming to capitalize on even small price movements.

High risk is inherent in day trading cryptocurrencies due to the volatile nature of the market. While the potential for significant profits exists, losses can also be substantial. Success depends heavily on skills, experience, and a well-defined trading plan.

Leverage is frequently employed by day traders to amplify potential gains, but this also significantly amplifies potential losses. Careful risk management is crucial to prevent catastrophic outcomes. It’s important to only trade with capital you can afford to lose.

The Importance of Market Analysis

Successful day trading in cryptocurrency hinges on accurate market analysis. Without understanding the current market trends and predicting potential price movements, you’re essentially gambling, not trading.

Technical analysis, focusing on chart patterns, indicators, and historical price data, helps identify potential entry and exit points. This allows you to capitalize on short-term price fluctuations.

Fundamental analysis, examining factors like news events, regulatory changes, and overall market sentiment, provides context to technical analysis. Understanding these factors can help you assess the long-term viability of a particular cryptocurrency and avoid risky trades.

Combining technical and fundamental analysis gives you a holistic view of the market, significantly increasing your chances of making profitable trades. Ignoring either aspect increases your risk of losses.

Consistent market analysis is not just about identifying opportunities; it’s also about managing risk. Understanding potential downsides and setting appropriate stop-loss orders is crucial to protecting your capital.

Ultimately, dedicating time and resources to thorough market analysis is an investment in your trading success. It’s a skill that requires continuous learning and adaptation to the ever-changing crypto landscape.

How to Use Technical Indicators

Technical indicators are mathematical calculations based on price and volume data, designed to generate trading signals. They help day traders identify potential entry and exit points, as well as trend reversals and momentum shifts.

Choosing the right indicators is crucial. Popular choices include moving averages (like the simple moving average or exponential moving average), which smooth out price fluctuations to identify trends; relative strength index (RSI), which measures momentum and identifies overbought or oversold conditions; and MACD (Moving Average Convergence Divergence), which helps spot momentum changes and potential trend reversals. There are many more, and the best choice depends on your trading style and the specific cryptocurrency.

Effective indicator usage involves more than just looking at one indicator. Combining indicators can provide more robust signals. For example, you might use a moving average crossover with RSI to confirm a buy or sell signal. Look for confirmation from multiple sources before making a trade.

Understanding indicator limitations is equally important. Indicators are not perfect predictors; they are tools to help inform your decisions, not dictate them. Market conditions can change rapidly, and indicators might lag behind these shifts. Always consider fundamental analysis and risk management in addition to technical analysis.

Practice is key. Start by backtesting your strategies using historical data to see how your chosen indicators would have performed. Then, practice with a small amount of capital in a demo account before risking real funds. Continuous learning and adaptation are essential for successful day trading.

Best Tools for Day Traders

Successful day trading hinges on having the right tools. Real-time data is paramount. You need access to live cryptocurrency price feeds, charts, and order books with minimal latency. Many exchanges offer their own platforms, but consider dedicated charting platforms like TradingView for advanced features.

Order execution speed is critical. Fast execution minimizes slippage, ensuring your trades are filled at the price you intend. Choose a brokerage with low latency and reliable infrastructure. Look into features such as advanced order types (limit, stop-loss, etc.) that allow for precise trade management.

Technical analysis tools are indispensable for identifying trading opportunities. Look for platforms that offer a wide range of indicators (moving averages, RSI, MACD, etc.), drawing tools, and customizable chart settings. The ability to screen and filter cryptocurrencies based on technical criteria is highly beneficial.

Risk management tools are just as important as trading tools. These might include stop-loss orders, position sizing calculators, and portfolio tracking tools. Sophisticated tools even allow backtesting different strategies to refine your approach.

Finally, consider news and sentiment analysis tools. Crypto markets are highly influenced by news events and social media sentiment. Staying informed through reputable news sources and social media monitoring tools can give you an edge. Remember to carefully assess information and avoid misinformation.

Managing Risks Effectively in Day Trading

Day trading, especially in the volatile cryptocurrency market, necessitates a robust risk management strategy. Without it, even the best trading strategies can lead to significant losses. Effective risk management isn’t about avoiding risk altogether; it’s about controlling it.

A crucial aspect is defining your risk tolerance. How much are you willing to lose on any single trade, or in a given trading session? This should be a percentage of your overall trading capital, not a fixed dollar amount. A common approach is to risk no more than 1-2% per trade. This ensures that even a series of losing trades won’t wipe out your account.

Stop-loss orders are your best friend. These orders automatically sell your cryptocurrency when the price drops to a predetermined level, limiting potential losses. Setting them strategically, based on your risk tolerance and technical analysis, is vital. Never underestimate the emotional toll of watching a trade go against you; stop-losses remove this emotional element.

Diversification helps spread your risk. Don’t put all your eggs in one basket. Invest in multiple cryptocurrencies, ensuring that a downturn in one doesn’t cripple your entire portfolio. This also helps to manage the unique risks associated with each individual cryptocurrency.

Position sizing is equally important. Calculate the appropriate amount to invest in each trade based on your risk tolerance and the volatility of the cryptocurrency. Avoid over-leveraging, a common mistake that can magnify losses dramatically.

Finally, continuous learning and adaptation are key. The cryptocurrency market is dynamic. Regularly review your trading strategies, analyze your performance, and adjust your risk management approach as needed. Staying informed about market trends and emerging risks is crucial for long-term success.

Top Cryptocurrencies for Day Trading

Choosing the right cryptocurrencies is crucial for successful day trading. Volatility is key, as it provides opportunities for quick profits. However, high volatility also means higher risk.

Bitcoin (BTC) remains a dominant force, offering liquidity and price movements suitable for day trading strategies. Its established market position makes it relatively less unpredictable than many altcoins.

Ethereum (ETH), the second-largest cryptocurrency, is another popular choice. Its smart contract capabilities and the thriving DeFi ecosystem contribute to significant price swings, providing trading opportunities. However, its price is often correlated with Bitcoin, impacting independent movement.

Smaller-cap altcoins can offer higher potential returns but come with increased risk. These cryptos are often more volatile and susceptible to rapid price changes. Careful research and risk management are absolutely paramount when trading altcoins.

Examples of altcoins sometimes used for day trading include Binance Coin (BNB), Solana (SOL), Cardano (ADA), and Ripple (XRP). Remember that the cryptocurrency market is constantly evolving; researching current market trends is vital for informed decisions. Diversification across several cryptocurrencies can help manage risk.

Ultimately, the best cryptocurrencies for day trading depend on your risk tolerance, trading style, and research. It’s essential to develop a robust trading plan that incorporates risk management techniques before engaging in any day trading activities.

Avoiding Emotional Decisions

Day trading cryptocurrency is inherently risky, and emotional decision-making can significantly amplify those risks. Fear and greed are the biggest culprits. Fear can lead to selling assets too early, cutting profits short, or even holding onto losing positions for too long in hopes of a recovery. Conversely, greed can cause you to overextend yourself, chasing unrealistic gains and ignoring sensible risk management.

To combat emotional trading, establish a clear trading plan before entering any trade. This plan should include entry and exit strategies based on technical indicators or price action, not gut feeling. Stick to your plan, regardless of market fluctuations. Develop a system of risk management, including stop-loss orders to limit potential losses. This helps protect your capital and prevents impulsive reactions to market volatility.

Discipline is crucial. Avoid impulsive trades based on news headlines or social media hype. Instead, rely on your pre-defined strategy and objective analysis. Consider maintaining a trading journal to track your trades, analyze successes and failures, and identify emotional biases. This fosters self-awareness and helps you refine your approach over time.

Finally, emotional detachment is key. Remember that trading is a business, and temporary setbacks are part of the process. Don’t let individual losses derail your overall strategy. Focus on the long-term picture and stick to your plan to mitigate the impact of emotional decisions on your trading performance.

The Role of News in Crypto Markets

News plays a crucial role in the volatile world of cryptocurrency day trading. Significant price swings are often triggered by news events, making staying informed absolutely essential.

Positive news, such as regulatory approvals, partnerships with major companies, or successful product launches, can lead to sharp price increases. Conversely, negative news, including security breaches, regulatory crackdowns, or negative statements from influential figures, can cause dramatic price drops.

Different types of news impact the market in varying ways. Regulatory announcements often carry the most weight, as they directly influence the legal landscape surrounding cryptocurrencies. Technological developments and market analysis reports can also significantly influence price movements.

Speed is key when reacting to news. Day traders need to be able to quickly assess the impact of news events and adjust their strategies accordingly. Reliable, up-to-the-minute news sources are therefore indispensable.

It’s important to remember that not all news is created equal. Learn to distinguish between credible sources and unreliable rumors or misinformation, as reacting to false information can be detrimental to your trading strategy.

Successful day trading in cryptocurrencies requires a combination of technical analysis, risk management, and a keen understanding of the impact of news. By effectively leveraging news events, traders can potentially increase their profitability.

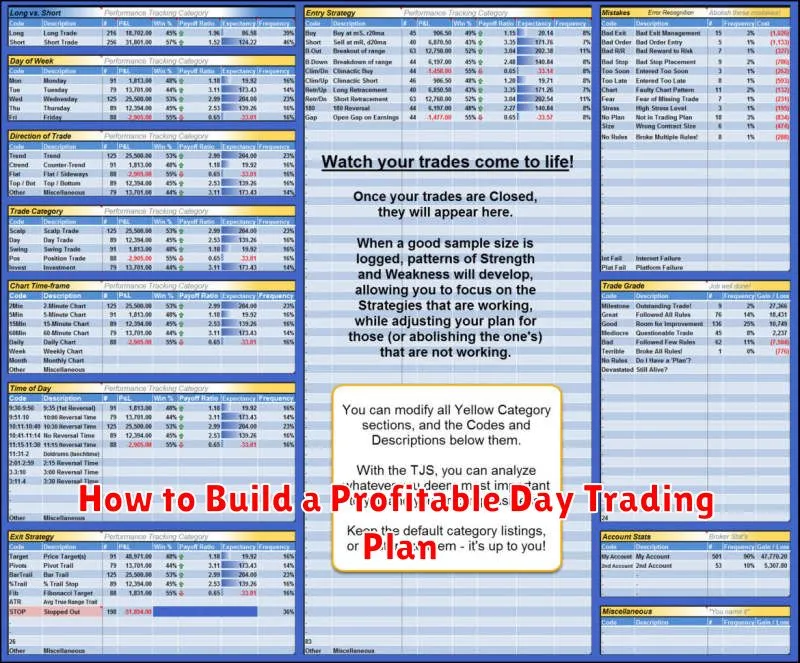

How to Build a Profitable Day Trading Plan

Building a profitable day trading plan requires a structured approach. It’s not about luck; it’s about consistent execution of a well-defined strategy.

First, define your goals. What’s your risk tolerance? What’s your desired profit target per trade? Knowing these specifics helps you avoid emotional decision-making.

Next, choose your cryptocurrency pairs. Focus on those with sufficient liquidity and volatility to allow for frequent, smaller trades. Research the market thoroughly to identify potential trading opportunities.

Develop your trading strategy. This involves selecting technical indicators (like moving averages, RSI, or MACD) that align with your trading style. Backtest this strategy using historical data to evaluate its effectiveness before live trading.

Risk management is paramount. Never risk more than a small percentage (e.g., 1-2%) of your capital on any single trade. Use stop-loss orders to limit potential losses and take-profit orders to secure profits.

Maintain a trading journal. Record every trade, including the entry and exit points, the rationale behind the trade, and the resulting profit or loss. This will help you identify areas for improvement and refine your strategy over time.

Practice consistently. Start with paper trading (simulated trading) to hone your skills and test your strategy without risking real capital. Gradually increase your trading volume as you gain confidence and experience.

Adapt and evolve. The cryptocurrency market is dynamic. Regularly review your trading plan and make necessary adjustments based on market conditions and your performance. Continuous learning and adaptation are crucial for long-term success.

Building a profitable day trading plan takes dedication and discipline. By focusing on these key elements, you significantly increase your chances of achieving consistent profitability in the volatile world of cryptocurrency trading.