Ready to build a passive income stream that’s both diversified and crypto-powered? This guide, “How to Create a Diversified Crypto Income Stream,” will walk you through proven strategies to generate multiple income sources using cryptocurrencies. Learn how to safely diversify your holdings, maximizing your returns while mitigating risk. We’ll cover everything from staking and lending to masternodes and yield farming, helping you build a robust and profitable crypto portfolio. Let’s unlock your financial freedom together!

Earning Through Staking

Staking is a popular method for generating passive income in the cryptocurrency world. It involves locking up your crypto assets on a blockchain network to help validate transactions and secure the network. In return for committing your funds, you earn rewards in the form of the native cryptocurrency.

The Annual Percentage Rate (APR) varies significantly depending on the cryptocurrency and the staking platform. Some offer higher returns than others, but higher returns often come with increased risk. It’s crucial to research thoroughly before choosing a staking platform to ensure its security and legitimacy.

Different cryptocurrencies have different staking mechanisms. Some require a minimum amount of cryptocurrency to stake, while others allow for smaller amounts. Some employ a Proof-of-Stake (PoS) consensus mechanism, while others use variations like Delegated Proof-of-Stake (DPoS). Understanding these mechanics is key to making informed decisions.

Before you start staking, carefully consider the risks involved. These include the risk of losing your staked assets due to platform vulnerabilities or smart contract bugs, as well as the possibility of fluctuating cryptocurrency prices impacting your overall return.

Diversifying your staking portfolio across multiple platforms and cryptocurrencies can help mitigate risk. Don’t put all your eggs in one basket. Research and choose reputable platforms with a proven track record of security and transparency.

Participating in Yield Farming

Yield farming is a popular strategy for generating passive income in the cryptocurrency world. It involves lending or staking your crypto assets to decentralized finance (DeFi) platforms in exchange for rewards.

How it works: You deposit your crypto into a liquidity pool or a staking contract. The platform then uses your assets to facilitate transactions or provide other services, rewarding you with interest or a share of the transaction fees.

Risks involved: Yield farming carries significant risks. Impermanent loss can occur when the price of the assets in the liquidity pool fluctuates. Furthermore, smart contract risks exist, meaning a bug in the platform’s code could lead to the loss of your funds. Always thoroughly research platforms before participating.

Choosing a platform: Select platforms with a proven track record, strong security measures, and transparent operations. Look for platforms with a large community and active development.

Diversification is key: Don’t put all your eggs in one basket. Spread your investments across multiple platforms and assets to mitigate risk. Consider the potential for smart contract vulnerabilities and market volatility.

Start small: Begin with a small amount of capital to test the waters and gain experience before committing larger sums.

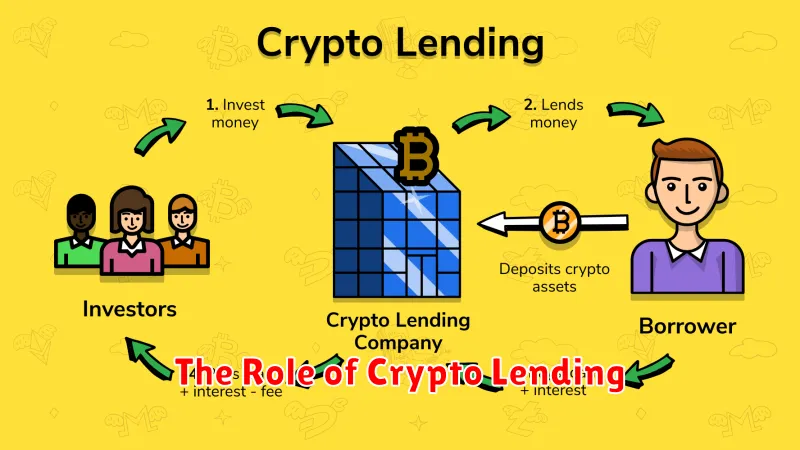

The Role of Crypto Lending

Crypto lending plays a significant role in building a diversified crypto income stream. It allows you to generate passive income by lending your cryptocurrencies to other users or institutions.

Platforms offering crypto lending services act as intermediaries, connecting borrowers and lenders. Lenders earn interest on their loaned assets, while borrowers gain access to capital for various purposes, such as trading or DeFi activities.

The interest rates offered vary depending on the platform, the cryptocurrency being lent, and market conditions. It’s crucial to research and compare different platforms before engaging in crypto lending to find the best rates and security measures.

While offering the potential for attractive returns, crypto lending involves inherent risks. These include the risk of platform insolvency, smart contract vulnerabilities, and market volatility affecting the value of your loaned assets. It’s essential to thoroughly understand these risks and choose reputable platforms with robust security protocols.

Diversifying your lending across multiple platforms and cryptocurrencies can help mitigate risk and potentially maximize returns. Proper risk management and due diligence are key to successfully integrating crypto lending into your overall crypto income strategy.

How to Use Crypto Cashback Programs

Crypto cashback programs offer a simple way to earn cryptocurrency while making everyday purchases. These programs partner with merchants to offer a percentage of your spending back in the form of crypto. The amount you earn varies depending on the program and merchant.

To begin, research different crypto cashback platforms. Look for programs that offer a good selection of merchants you frequently use and a competitive cashback rate. Consider factors like the types of cryptocurrencies offered and any associated fees.

Once you’ve chosen a program, you’ll typically need to sign up and link a payment method, usually a credit or debit card. Then, simply shop at participating merchants as you normally would. Make sure to activate the cashback offer before making your purchase to ensure you receive your rewards.

After your purchase, the cashback will usually be credited to your account within a few days or weeks, depending on the platform. You can then withdraw your earnings to your cryptocurrency wallet. It’s crucial to regularly check your account for any credited cashback and to understand the withdrawal process.

Remember to compare different programs and choose the one that best suits your spending habits and cryptocurrency preferences. While it might seem like small amounts at first, consistent use can significantly add up over time, providing a passive but valuable stream of crypto income.

Generating Income from Airdrops

Airdrops, the free distribution of cryptocurrency tokens, offer a potentially lucrative way to diversify your crypto income stream. However, it’s crucial to approach them strategically.

Participating in airdrops requires active engagement. This often involves tasks such as joining Telegram groups, following projects on social media, retweeting announcements, or completing quizzes. The more active you are, the higher your chances of receiving tokens.

Thorough research is key. Not all airdrops are created equal. Investigate the project’s whitepaper, team, and overall legitimacy before dedicating time and effort. Scams are prevalent, so caution is paramount. Look for projects with a solid track record or strong community backing.

Diversify your participation. Don’t put all your eggs in one basket. Participate in multiple airdrops to mitigate the risk associated with any single project failing or delivering low-value tokens.

Manage your expectations. While airdrops can be profitable, they shouldn’t be considered a primary income source. Treat them as supplemental income opportunities and celebrate small wins along the way.

Security is critical. Be wary of phishing scams and malicious links. Only interact with official project channels and websites to avoid losing your crypto or personal information.

By following these steps, you can effectively leverage airdrops to generate additional income and further diversify your cryptocurrency portfolio.

The Benefits of Mining for Passive Income

Mining cryptocurrencies can offer a compelling route to passive income. Once your mining setup is established, it operates largely autonomously, generating income while requiring minimal ongoing effort from you.

A key benefit is the potential for significant returns. While market volatility exists, successful mining operations can yield substantial profits, especially with profitable cryptocurrencies and efficient hardware.

Furthermore, mining provides a degree of financial independence. Unlike many passive income streams reliant on third parties, mining gives you direct control over your earnings, reducing dependence on external factors.

However, it’s crucial to understand that mining requires an initial investment in specialized hardware, electricity, and potentially cooling solutions. The profitability is also highly sensitive to factors such as cryptocurrency prices, mining difficulty, and electricity costs. Thorough research is essential.

Finally, mining contributes to the security and decentralization of the blockchain network, making it a rewarding endeavor beyond mere profit generation.

Exploring DeFi Opportunities

Decentralized Finance (DeFi) offers a compelling avenue for diversifying your crypto income stream. It leverages blockchain technology to provide traditional financial services in a permissionless and transparent manner.

Yield farming is a popular DeFi strategy. This involves lending your crypto assets to decentralized lending platforms in exchange for interest. The interest rates can be significantly higher than traditional savings accounts, but carry higher risk due to the volatile nature of the crypto market and potential smart contract vulnerabilities.

Liquidity provision is another key DeFi opportunity. By providing liquidity to decentralized exchanges (DEXs), you earn trading fees. This requires understanding impermanent loss, a risk inherent in providing liquidity to trading pairs.

Staking allows you to lock up your crypto assets to support the security and operation of a blockchain network. In return, you receive rewards in the native token of the blockchain. The rewards vary significantly depending on the specific blockchain and its network activity.

Before engaging in any DeFi activity, it’s crucial to conduct thorough research. Understand the risks involved, including smart contract risks, impermanent loss, and market volatility. Only invest what you can afford to lose. Consider using only reputable platforms and diversifying your investments across different DeFi protocols to mitigate risks.

Tips for Sustainable Crypto Income Streams

Building a sustainable crypto income stream requires careful planning and diversification. Avoid get-rich-quick schemes; focus on strategies with long-term potential.

Diversify your holdings across multiple cryptocurrencies and investment strategies. Don’t put all your eggs in one basket. This mitigates risk and enhances the chances of consistent returns.

Invest in education. Understanding blockchain technology, market trends, and various investment strategies is crucial for making informed decisions. Continuous learning is key to staying ahead of the curve.

Employ a disciplined approach to risk management. Define your risk tolerance and stick to it. Never invest more than you can afford to lose. Consider using stop-loss orders to protect your investments.

Explore passive income streams like staking, lending, and yield farming. While these can be profitable, carefully research platforms and understand the associated risks. Always prioritize security.

Reinvest profits wisely. Compounding your earnings is essential for exponential growth. Develop a clear reinvestment strategy and regularly assess its effectiveness.

Stay informed about regulations. The cryptocurrency landscape is constantly evolving. Stay up-to-date on the latest regulatory changes and how they might impact your income streams.

Tax optimization is crucial. Understand the tax implications of your crypto activities in your jurisdiction. Seek professional tax advice if needed to minimize your tax burden.

Patience and persistence are paramount. Building a sustainable crypto income stream takes time and effort. Don’t get discouraged by short-term market fluctuations; focus on the long-term vision.

Consider professional advice. Consulting with a financial advisor specializing in cryptocurrencies can provide valuable insights and guidance. They can help you tailor a strategy that aligns with your financial goals and risk tolerance.