Looking to generate passive income in 2024? The world of cryptocurrency offers exciting opportunities to earn while you sleep. This guide explores the best cryptocurrencies for passive income, highlighting top contenders like staking coins, lending platforms, and yield farming opportunities. Discover how to diversify your portfolio and maximize your returns with our expert analysis of the most promising passive income crypto options for the new year. Let’s dive into the best ways to earn passive income with cryptocurrency in 2024!

What is Passive Income in Crypto?

Passive income in crypto refers to earning cryptocurrency without actively working for it. Unlike a typical job where you trade time for money, passive income strategies require an initial investment of time or capital, followed by relatively low maintenance.

Key methods for generating passive income in crypto include: staking (locking up your crypto to validate transactions on a blockchain), lending (loaning your crypto to others for interest), and yield farming (providing liquidity to decentralized exchanges (DEXs) in exchange for rewards). Each method carries varying levels of risk and reward.

It’s crucial to understand that while the term “passive” suggests minimal effort, monitoring and managing your investments are still necessary. Market volatility and platform risks are factors to consider, requiring regular checks to ensure your investments remain safe and profitable. While the potential for significant returns exists, there’s also the possibility of losses.

Ultimately, passive crypto income is about leveraging blockchain technology to generate returns with minimal ongoing effort, but it’s not entirely “hands-off” and requires a degree of understanding of the risks involved.

Ethereum (ETH) Staking Rewards

Ethereum (ETH) staking offers a compelling passive income opportunity in 2024. After the merge to a proof-of-stake (PoS) consensus mechanism, users can now earn rewards by locking up their ETH and participating in the network’s validation process.

The amount of reward you receive depends on several factors, including the total amount of ETH staked and the network’s overall activity. While rates fluctuate, you can generally expect a percentage return on your staked ETH annually. This return is passive, requiring minimal effort beyond the initial staking process. Note that there are costs associated with staking, most notably the gas fees involved in the initial transaction and potentially unstaking.

Staking ETH contributes to the security and stability of the Ethereum network. By locking up your ETH, you’re actively helping to secure the blockchain and earn rewards in return. This makes ETH staking a particularly attractive option for those seeking both passive income and participation in a robust and established blockchain ecosystem. It’s important to research and understand the risks involved before staking your ETH, choosing a reputable staking provider is crucial.

Cardano (ADA) Staking Opportunities

Cardano (ADA) offers excellent opportunities for passive income through staking. Unlike some cryptocurrencies, Cardano’s proof-of-stake (PoS) consensus mechanism allows you to earn rewards simply by holding and securing the network.

How it works: You delegate your ADA tokens to a stake pool operated by a third party. This pool validates transactions on the Cardano blockchain, and in return, you receive a share of the block rewards – your passive income. The amount you earn depends on factors like the pool’s performance and the total ADA staked.

Choosing a stake pool: Research is crucial. Look for pools with a good track record, reasonable fees, and a healthy amount of ADA staked. Avoid pools with extremely high pledge, as this can indicate potential issues.

Risks: While generally safe, staking does involve some risk. You should only stake ADA you can afford to lose and carefully consider the reputation and performance of the chosen stake pool. The rewards themselves are also subject to market volatility.

Getting started: Numerous exchanges and wallets support ADA staking. You’ll need to research and select one that meets your needs. Once you have your ADA, choose a pool, and delegate your tokens. Your rewards will accrue over time.

In summary: Cardano staking presents a relatively straightforward way to generate passive income with your ADA holdings. However, thorough research and due diligence are always recommended before participating.

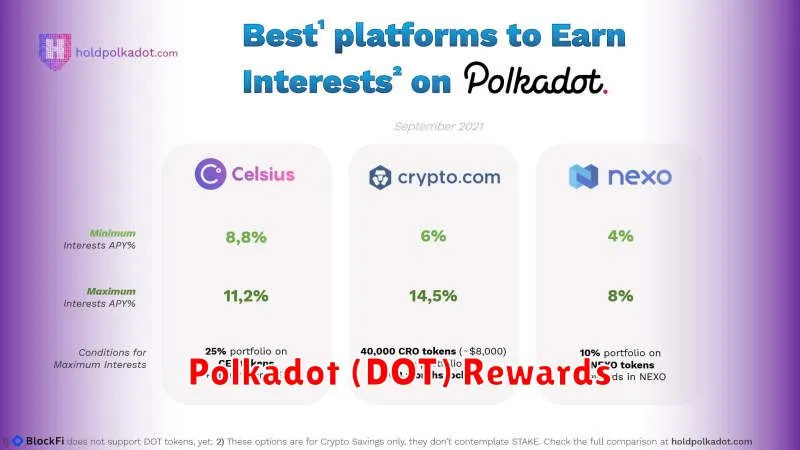

Polkadot (DOT) Rewards

Polkadot (DOT) offers several avenues for passive income generation. Staking is a primary method; by locking up your DOT tokens, you participate in securing the network and earn rewards in the form of more DOT. The amount earned depends on the validator you choose and the overall network activity.

Beyond staking, participating in governance also provides rewards. Voting on proposals and contributing to Polkadot’s ecosystem development can earn you DOT. The frequency and amount of rewards vary based on your involvement and the complexity of the proposals.

Another way to earn passive income with DOT is through parachain auctions. While more involved, successfully participating in these auctions by bonding DOT to support a parachain can yield significant rewards, but it also involves a higher level of risk.

It’s crucial to understand that risks exist with all passive income strategies, and Polkadot is no exception. Network changes, market volatility, and validator performance can all impact your earnings. Thorough research and a cautious approach are essential before investing in any cryptocurrency, including Polkadot.

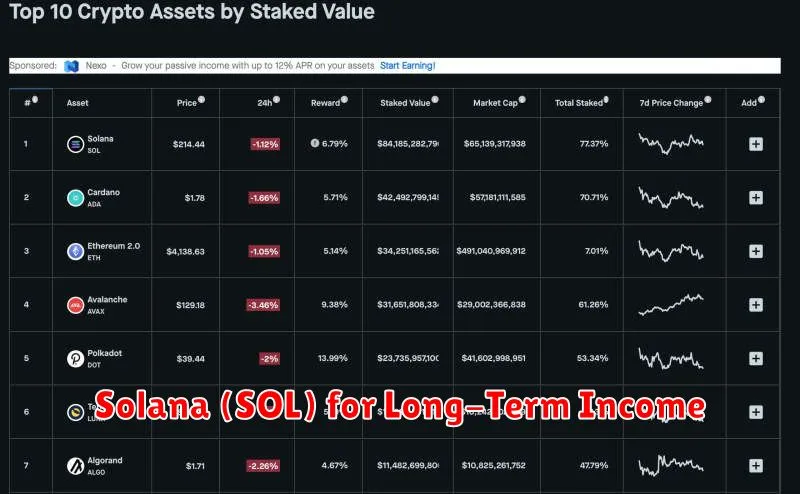

Solana (SOL) for Long-Term Income

Solana offers several avenues for generating passive income in the long term. Its high transaction speeds and low fees make it attractive for various DeFi activities.

Staking SOL is a popular method. By locking up your tokens, you earn rewards from transaction fees and block validation. The annual percentage yield (APY) can vary, so research current rates before committing.

Providing liquidity on decentralized exchanges (DEXs) built on Solana is another option. You earn trading fees proportional to your contribution to the liquidity pool. However, understand the risks involved, including impermanent loss.

Participating in yield farming strategies on Solana-based platforms can generate higher returns. This often involves lending, borrowing, and staking across different protocols, but it also carries higher risks.

Finally, consider investing in Solana-based projects. Early adoption of promising projects can lead to substantial gains over the long term. Thorough research and due diligence are crucial before investing.

Disclaimer: Investing in cryptocurrency carries significant risk. The value of your investments can fluctuate dramatically, and you could lose money. This information is for educational purposes only and not financial advice.

Cosmos (ATOM) Staking Benefits

Staking Cosmos (ATOM) offers a compelling way to generate passive income in the cryptocurrency space. By locking up your ATOM tokens, you participate in securing the Cosmos Hub network and earn rewards in return.

One of the key benefits is the relatively high annual percentage yield (APY) compared to other staking options. This APY fluctuates based on network activity and the number of validators, but generally remains attractive to investors seeking passive income.

Furthermore, staking ATOM contributes to the decentralization and security of the Cosmos ecosystem. As a staker, you play a vital role in maintaining the network’s integrity and reliability.

The process of staking ATOM is also relatively straightforward, with various exchanges and wallets offering user-friendly staking services. This accessibility makes it a convenient option for both beginners and experienced crypto investors.

However, it’s important to note that staking involves locking up your assets for a period of time, and the rewards are not guaranteed. Market conditions and network dynamics can influence the APY and the overall profitability of staking.

In summary, Cosmos (ATOM) staking presents a potentially lucrative avenue for passive income generation, offering a blend of competitive returns and participation in a robust blockchain network. Always research and understand the risks involved before staking any cryptocurrency.

The Role of Stablecoins in Passive Income

While not directly generating passive income like some other cryptocurrencies, stablecoins play a crucial role in facilitating it. Their primary function is to maintain a stable value, typically pegged to the US dollar. This stability makes them ideal for several passive income strategies.

One key role is in earning interest. Many centralized and decentralized finance (DeFi) platforms offer high-yield savings accounts and lending opportunities using stablecoins. You can deposit your stablecoins and earn interest, essentially generating passive income with minimal risk compared to volatile cryptocurrencies.

Another application is in arbitrage trading. Stablecoins can be used to exploit price discrepancies between different exchanges, generating small profits consistently. This requires monitoring and active management, blurring the line between passive and active income, but with automation tools, it can be partially passive.

Finally, stablecoins provide a safe haven for your crypto holdings. When the market is volatile, you can move your more risky assets into stablecoins, preserving value and preventing potential losses. This allows you to re-enter the market strategically, potentially maximizing gains when prices rebound, which indirectly supports your passive income goals.

In summary, while not a direct source of passive income themselves, stablecoins are essential tools for maximizing returns and mitigating risks in your overall passive income strategy within the crypto market.

Using Yield Farming for Income

Yield farming is a popular method for generating passive income in the cryptocurrency space. It involves lending or staking your crypto assets to decentralized finance (DeFi) platforms in exchange for rewards. These rewards are typically paid in the platform’s native token or other cryptocurrencies.

The Annual Percentage Yield (APY) offered by yield farming platforms can vary significantly, depending on factors such as the platform itself, the cryptocurrency being staked, and the current market conditions. Some platforms offer extremely high APYs, but it’s crucial to remember that higher returns often come with higher risks.

Risks associated with yield farming include: impermanent loss (the loss incurred when the price of your staked assets changes relative to each other), smart contract vulnerabilities (bugs in the platform’s code could lead to loss of funds), and rug pulls (developers abandoning the platform and taking the user’s funds).

Before engaging in yield farming, it’s essential to conduct thorough research on the platform you’re considering. Understand the risks involved and only invest what you can afford to lose. Diversifying your investments across multiple platforms can help mitigate some of the risks. Always prioritize platforms with a proven track record and strong security measures.

While yield farming can be a lucrative way to generate passive income, it’s not without its challenges. Careful planning, diligent research, and risk management are critical to achieving success in this area of the crypto market.

Avoiding Risks in Passive Income Strategies

While passive income from cryptocurrencies offers exciting potential, it’s crucial to acknowledge and mitigate inherent risks. Diversification is paramount. Don’t put all your eggs in one basket; spread your investments across different cryptocurrencies and passive income strategies to reduce the impact of any single asset’s downturn. This minimizes your exposure to potential losses.

Thorough research is essential before investing in any cryptocurrency or platform. Understand the project’s whitepaper, team, and technology. Evaluate the overall market conditions and be aware of the volatility inherent in the cryptocurrency market. Don’t invest based solely on hype or promises of quick riches.

Security should be a top priority. Use reputable and secure wallets and exchanges. Enable two-factor authentication (2FA) and be vigilant about phishing scams and other online threats. Regularly review your security practices to adapt to evolving threats.

Risk tolerance is a personal factor. Only invest an amount you can afford to lose. Passive income strategies, while potentially lucrative, are not guaranteed to generate profit. A realistic understanding of potential losses is crucial for managing your financial well-being.

Finally, stay informed. The cryptocurrency market is constantly evolving. Keep abreast of market trends, regulatory changes, and technological advancements that could impact your investments. Regularly review your portfolio and adjust your strategy as needed.