Navigating the world of cryptocurrency can be exciting, but understanding crypto taxes can feel like deciphering a complex code. This beginner’s guide will demystify the process, helping you understand capital gains taxes, taxable events like staking and mining, and how to properly report your cryptocurrency transactions. Whether you’re a seasoned investor or just starting your crypto journey, learning about crypto tax laws is crucial for avoiding penalties and staying compliant. Let’s dive into the essentials of crypto tax reporting and make filing your taxes a breeze!

What are Crypto Taxes?

Crypto taxes are the taxes you owe on any profits you make from buying, selling, or trading cryptocurrencies. This includes gains from selling crypto for fiat currency (like USD), trading one cryptocurrency for another (e.g., Bitcoin for Ethereum), or using crypto to purchase goods and services.

The specific tax rules surrounding crypto vary significantly depending on your location. Some countries treat crypto as property, while others classify it as a commodity or currency. This difference in classification directly impacts how your crypto transactions are taxed. For example, in some jurisdictions, short-term gains (crypto held for less than a year) may be taxed at a higher rate than long-term gains.

Capital gains taxes are the most common type of tax applied to cryptocurrency transactions. These taxes are levied on the difference between the price you bought a cryptocurrency for and the price you sold it for. However, you might also owe income taxes if you receive crypto as payment for goods or services, or if you earn interest or rewards from staking or lending your crypto.

It’s crucial to understand the tax laws in your jurisdiction regarding cryptocurrency. Failure to accurately report and pay your crypto taxes can result in significant penalties and legal repercussions. Consult with a tax professional specializing in cryptocurrency for personalized advice.

Types of Crypto Transactions Subject to Tax

Navigating the world of crypto taxes can be daunting, especially for beginners. Understanding which transactions are taxable is the first step. Several types of cryptocurrency transactions trigger tax liabilities in most jurisdictions.

Buying cryptocurrency with fiat currency (like USD or EUR) is generally considered a taxable event. The cost basis is the amount you paid, and any subsequent appreciation in value is subject to capital gains tax when you sell.

Selling cryptocurrency for fiat currency or other cryptocurrencies is also a taxable event. The difference between your selling price (proceeds) and your cost basis determines your capital gain or loss. This applies even if you exchange one cryptocurrency for another (e.g., Bitcoin for Ethereum).

Mining cryptocurrency is considered taxable income. The fair market value of the mined cryptocurrency at the time it’s received is considered your income for tax purposes.

Staking cryptocurrency, where you lock up your coins to help secure a blockchain, can also generate taxable income. The rewards received are generally treated as taxable income, similar to mining.

Using cryptocurrency to pay for goods and services is another taxable transaction. The value of the cryptocurrency used is considered the cost of the goods or services, and any difference from your cost basis will generate a capital gain or loss.

Airdrops and hard forks, where you receive additional cryptocurrency without any action on your part, are generally considered taxable events. The fair market value of the received cryptocurrency at the time of receipt is taxable income.

It’s crucial to keep accurate records of all your cryptocurrency transactions, including dates, amounts, and cost basis. Consulting with a qualified tax professional is highly recommended to ensure compliance with all applicable tax laws.

How to Calculate Your Crypto Gains and Losses

Calculating your crypto gains and losses for tax purposes can seem daunting, but it’s manageable with a systematic approach. The key is to track each transaction accurately. For every cryptocurrency you own, you need to record the date of purchase, the amount purchased, and the price paid (in USD). This includes all purchases, sales, and any other events that affect your cryptocurrency holdings like receiving crypto as payment or earning interest.

The most common method to calculate gains and losses is the First-In, First-Out (FIFO) method. With FIFO, you assume you sold the oldest cryptocurrencies first. For example, if you bought 1 BTC at $30,000 and later bought 1 BTC at $40,000, and then sold 1 BTC at $50,000, your gain would be calculated as $50,000 (sale price) – $30,000 (cost basis) = $20,000.

Another method is Last-In, First-Out (LIFO), where you assume you sold your most recently acquired cryptocurrencies first. Using the same example, your gain using LIFO would be $50,000 – $40,000 = $10,000. The choice between FIFO and LIFO can significantly impact your tax liability. Consult a tax professional to determine the best method for your specific situation.

Beyond simple buy and sell transactions, you need to account for other events such as staking rewards, airdrops, and forking. These events often create taxable income. Accurate record-keeping is crucial to avoid penalties. Consider using crypto tax software to simplify the process, especially if you have many transactions.

Remember, tax laws vary by jurisdiction. It’s essential to understand the specific regulations in your country or region. Seeking professional tax advice is highly recommended to ensure compliance and minimize potential tax liabilities. Failing to accurately report your crypto transactions can lead to significant penalties.

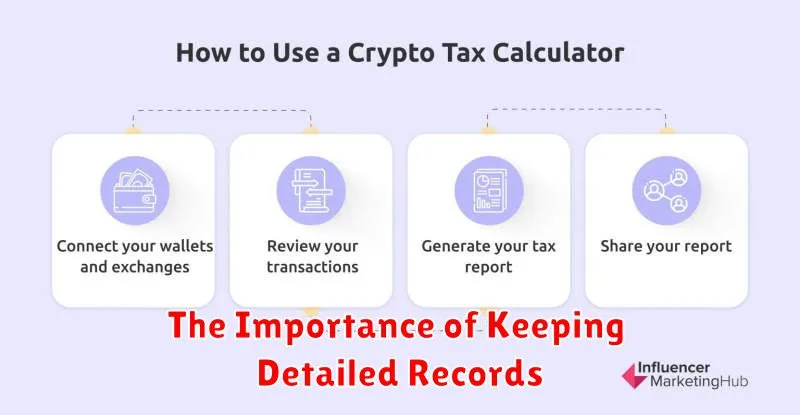

The Importance of Keeping Detailed Records

Accurately reporting your crypto transactions for tax purposes is crucial, and this hinges on maintaining detailed records. The IRS requires meticulous documentation, and failing to provide this can lead to significant penalties.

Comprehensive records should include the date of each transaction, the type of cryptocurrency involved, the amount of cryptocurrency acquired or disposed of, the fair market value at the time of the transaction, and the recipient or sender’s information. This applies to all activities, including buying, selling, trading, staking, mining, and even receiving crypto as gifts.

Keeping track of every transaction might seem daunting, but using crypto tax software or spreadsheets can significantly simplify this process. These tools can often automatically import transaction history from various exchanges and wallets, making record-keeping far more manageable. Organizing your records from the outset will save you considerable time and stress during tax season.

Remember, the penalties for inaccurate reporting can be severe. Proper record-keeping is not just advisable; it’s essential for navigating the complexities of crypto taxation and avoiding potential legal issues. Your detailed records are your best defense against audit scrutiny and unexpected tax liabilities.

Tax Software for Crypto Users

Navigating the complex world of crypto taxes can be daunting, especially for beginners. Fortunately, several tax software programs are designed to simplify the process. These tools automate many of the tedious calculations involved in reporting your crypto transactions to the IRS.

Key features to look for in crypto tax software include: support for various exchanges, automatic import of transaction history, calculation of capital gains and losses, and generation of tax forms (like Form 8949). Some programs even offer tax planning tools and professional support.

Popular options include CoinTracker, CryptoTrader.Tax, and TaxBit. Each platform offers varying levels of features and pricing, so it’s crucial to research and choose the one that best fits your individual needs and tax situation. Remember to always verify the accuracy of the software’s calculations and consult with a qualified tax professional if you have complex transactions or require personalized advice.

Using tax software can significantly reduce the time and effort required to prepare your crypto tax returns, minimizing the chances of errors and ensuring compliance with tax laws. This is crucial because penalties for inaccurate reporting can be substantial.

Common Mistakes in Crypto Tax Filing

Navigating crypto taxes can be tricky, even for experienced investors. One common mistake is failing to track all transactions. This includes every buy, sell, trade, and even airdrops. Accurate record-keeping is crucial for accurate reporting.

Another frequent error is misunderstanding the tax basis. Many beginners incorrectly calculate their gains or losses, overlooking factors like the cost basis of each cryptocurrency and the date of acquisition. Using proper accounting software can help mitigate this.

Ignoring the wash-sale rule is another pitfall. This rule prevents taxpayers from deducting losses if they repurchase the same cryptocurrency within a specific timeframe. Understanding this rule is vital for minimizing tax liabilities.

Many also make the mistake of not considering the different tax implications of various crypto activities. Staking, lending, and forking all have unique tax consequences that need to be addressed separately. Consult a tax professional if you’re unsure.

Finally, failing to file on time can lead to penalties and interest. Crypto tax deadlines are the same as regular tax deadlines, so be sure to stay organized and submit your returns promptly. Remember, accurate record-keeping is your best defense.

The Role of Crypto in Retirement Planning

While still a relatively new asset class, cryptocurrency is increasingly considered by some as a potential component of a retirement plan. Its high growth potential, though volatile, attracts investors seeking potentially higher returns than traditional investments like bonds or stocks. However, it’s crucial to approach it with caution and realistic expectations.

Diversification is key. Crypto should never represent a significant portion of your retirement portfolio unless you have a high risk tolerance and understand the potential for substantial losses. It’s recommended to treat crypto as a small part of a larger, diversified strategy including more established assets.

Tax implications are significant and complex. Understanding how cryptocurrency transactions are taxed is crucial before including it in your retirement plan. Gains and losses are taxable events, and the specific regulations vary by jurisdiction. Failing to accurately report your crypto activity can lead to serious penalties. Consult with a qualified tax advisor to understand your specific situation.

Long-term holding strategies (HODLing) are often employed by those who believe in the long-term potential of specific cryptocurrencies. However, this strategy doesn’t negate the importance of regular portfolio reviews and rebalancing, and it is still subject to market fluctuations.

Self-custody versus exchange-held crypto carries different levels of risk and tax considerations. Keeping track of your crypto holdings, regardless of how they’re stored, is essential for accurate tax reporting.

In summary, while cryptocurrency *could* play a role in your retirement plan, it’s vital to proceed with informed decision-making, considering the risks involved, seeking professional advice, and understanding the complex tax implications. It’s never a substitute for a well-diversified and carefully planned retirement strategy.

Tax Implications of Staking and Mining Rewards

Staking and mining cryptocurrency rewards are considered taxable income in most jurisdictions. This means you’ll need to report these rewards to the relevant tax authorities and pay taxes on the gains.

The tax rate applied will depend on your individual circumstances and the specific tax laws of your country of residence. It’s often treated as ordinary income, subject to your usual income tax bracket. However, some countries may have specific rules for cryptocurrency taxation.

Calculating your taxable income involves determining the fair market value (FMV) of the rewards at the time they are received. This can be challenging as cryptocurrency prices fluctuate constantly. It’s crucial to maintain accurate records of all your transactions, including the date, amount, and FMV of each reward.

Record-keeping is vital. Keep detailed logs of your staking and mining activities, including the cryptocurrency used, the amount of rewards received, and the date and time of each transaction. This documentation will be essential when filing your tax returns.

Seeking professional advice is recommended. Tax laws concerning cryptocurrency are complex and constantly evolving. Consulting a tax professional or accountant familiar with cryptocurrency taxation can help ensure compliance and minimize potential tax liabilities.