Navigating the complex world of crypto taxes can be daunting, but it doesn’t have to be! In 2024, staying compliant with crypto tax laws is more important than ever. This is why we’ve compiled a list of the top tools for crypto tax tracking to help you effortlessly manage your crypto tax reporting. Whether you’re a seasoned trader or just starting out, these best crypto tax software options will simplify the process, saving you time and potentially money. Discover the best crypto tax software 2024 has to offer and say goodbye to tax season stress!

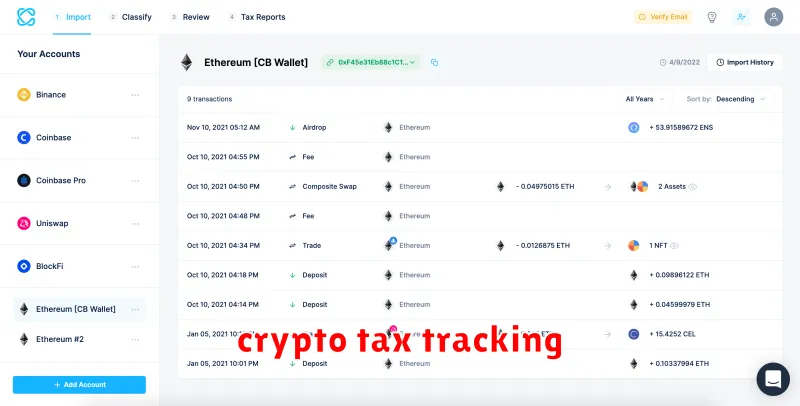

CoinTracker

CoinTracker is a popular crypto tax software designed to simplify the process of tracking your cryptocurrency transactions for tax purposes. It supports a wide range of exchanges and wallets, automatically importing your transaction history to calculate your capital gains and losses. The platform offers various features, including tax form generation (like Form 8949) and portfolio tracking to help you stay organized.

One of its key strengths lies in its user-friendly interface, making it relatively easy to navigate even for those unfamiliar with crypto tax regulations. CoinTracker also provides robust reporting features, allowing you to easily understand your crypto tax liabilities. However, keep in mind that the pricing can vary depending on your needs and transaction volume.

Overall, CoinTracker is a strong contender in the crypto tax software market, offering a comprehensive solution for individuals and businesses looking to streamline their crypto tax reporting. Its ease of use and comprehensive features make it a worthwhile option to consider, though users should always verify the accuracy of its calculations.

CryptoTaxCalculator

CryptoTaxCalculator is a popular choice for crypto tax tracking, offering a user-friendly interface and comprehensive features. It supports a wide range of cryptocurrencies and exchanges, automatically importing transaction data for simplified reporting.

A key benefit is its ability to calculate your capital gains and losses accurately, considering various tax implications. The software also generates tax reports compliant with various regional tax regulations, saving you time and effort in preparing your tax filings.

While it offers a free plan with limited functionality, its paid plans unlock more features, including support for more transactions and advanced reporting options, making it suitable for both casual and serious crypto investors.

However, users should be aware that the accuracy of tax calculations depends heavily on the completeness and accuracy of the data imported. Always double-check the generated reports before filing.

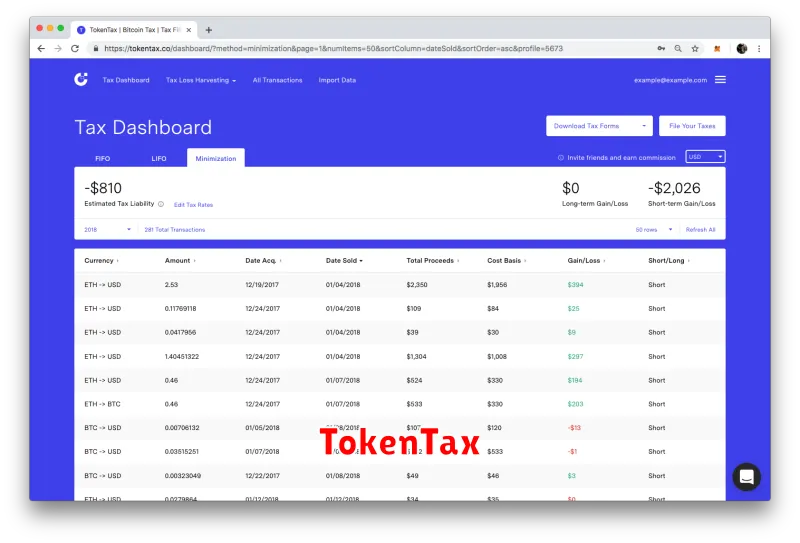

TokenTax

TokenTax is a popular choice for crypto tax tracking, especially for those needing a streamlined and user-friendly experience. Its strength lies in its intuitive interface and automated features, simplifying the often complex process of calculating your crypto gains and losses. It supports a wide range of cryptocurrencies and exchanges, making it suitable for diverse portfolios.

One key benefit is its ability to connect directly to various cryptocurrency exchanges, automatically importing transaction history. This significantly reduces manual data entry, saving you valuable time and minimizing errors. TokenTax also offers robust reporting features, generating the necessary tax forms compliant with various jurisdictions. While it’s a paid service, many users find the convenience and accuracy well worth the cost, particularly those with larger or more complex crypto holdings.

However, a potential drawback for some could be the subscription pricing model. While it offers different tiers based on the amount of transactions, the cost might be prohibitive for individuals with very small portfolios. Nevertheless, for many, TokenTax provides a reliable and efficient solution for navigating the complexities of crypto tax reporting.

Koinly

Koinly is a popular crypto tax software designed to simplify the process of tracking your cryptocurrency transactions for tax purposes. It supports a wide range of exchanges and wallets, automatically importing your transaction history for easy analysis.

One of Koinly’s key features is its ability to generate various tax reports, including those compliant with different countries’ tax regulations. This makes it a versatile tool for users worldwide. The platform also offers tools to help calculate your capital gains and losses, making tax preparation significantly less daunting.

While generally user-friendly, some users find the pricing a potential drawback, particularly for those with smaller portfolios. However, for those needing a comprehensive and automated solution to crypto tax reporting, Koinly is a strong contender.

Key features often highlighted by users include its intuitive interface, robust import functionality, and the ability to generate various tax reports tailored to specific jurisdictions. However, potential users should carefully consider the pricing tiers before committing.

ZenLedger

ZenLedger is a popular and powerful crypto tax software designed to simplify the complex process of tracking your cryptocurrency transactions for tax purposes. It supports a wide range of exchanges and wallets, automatically importing your transaction history to calculate your capital gains and losses.

One of its key features is its ability to handle various cryptocurrency events, including staking rewards, airdrops, and DeFi activities, which are often overlooked by simpler tools. This comprehensive approach helps ensure accurate tax reporting.

ZenLedger offers various pricing plans to suit different needs, from individuals with simple transactions to professional traders with extensive portfolios. It also provides tax form generation, making filing your taxes significantly easier. The platform is known for its user-friendly interface and robust customer support, making it a strong contender for crypto tax management in 2024.

While its automated features are a significant advantage, users should always double-check the generated reports to ensure accuracy. This is best practice for any tax software, regardless of its capabilities.

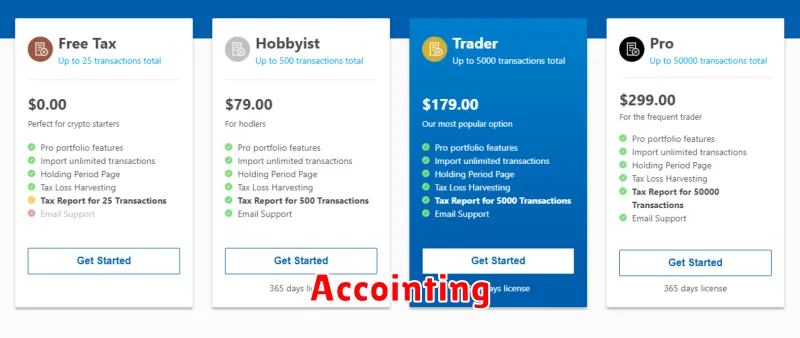

Accointing

Accointing is a popular cryptocurrency tax software known for its user-friendly interface and comprehensive features. It supports a wide range of exchanges and wallets, automatically importing your transaction history for easy tracking. The platform handles various crypto activities, including staking, airdrops, and DeFi transactions, making it suitable for both casual and advanced crypto investors.

One of its key strengths is its ability to generate various tax reports compliant with different countries’ regulations. This makes Accointing a valuable tool for users worldwide. While it offers a free plan with limited features, its paid plans unlock features like advanced reporting, portfolio tracking, and unlimited transaction history.

Users consistently praise Accointing’s ease of use, even for those unfamiliar with tax software. The intuitive design makes navigating the platform and generating reports straightforward. However, the pricing for premium features can be a factor to consider when compared to other options.

TaxBit

TaxBit is a powerful and comprehensive crypto tax software solution designed to simplify the complexities of reporting your cryptocurrency transactions. It supports a wide range of exchanges and wallets, automatically importing your transaction history for accurate and efficient tax calculations.

One of its key features is its ability to handle various types of crypto transactions, including staking, lending, and airdrops, often overlooked by simpler tools. TaxBit also offers professional tax preparation support, helping you navigate the intricacies of crypto tax laws and confidently file your returns.

While it offers a free plan for basic usage, its premium features, like advanced reporting and professional support, come at a cost. However, for users with significant crypto activity or a need for peace of mind regarding accurate tax reporting, the investment might be well worth it.

CoinLedger

CoinLedger is a leading cryptocurrency tax software designed to simplify the complex process of calculating your crypto taxes. It supports a wide range of exchanges and wallets, automatically importing your transaction history for seamless tracking.

One of its key features is its ability to handle various tax situations, including staking rewards, airdrops, and DeFi transactions. CoinLedger generates comprehensive tax reports compliant with IRS regulations, reducing the burden of manual calculations and minimizing the risk of errors.

The platform offers various pricing tiers to cater to different needs and trading volumes, making it accessible to both casual investors and seasoned traders. Its user-friendly interface and comprehensive reporting features make it a strong contender for anyone seeking efficient crypto tax management.

Key benefits include automated transaction importing, support for multiple exchanges and wallets, generation of compliant tax forms, and various pricing options. However, users should carefully review the pricing structure to ensure it aligns with their usage.

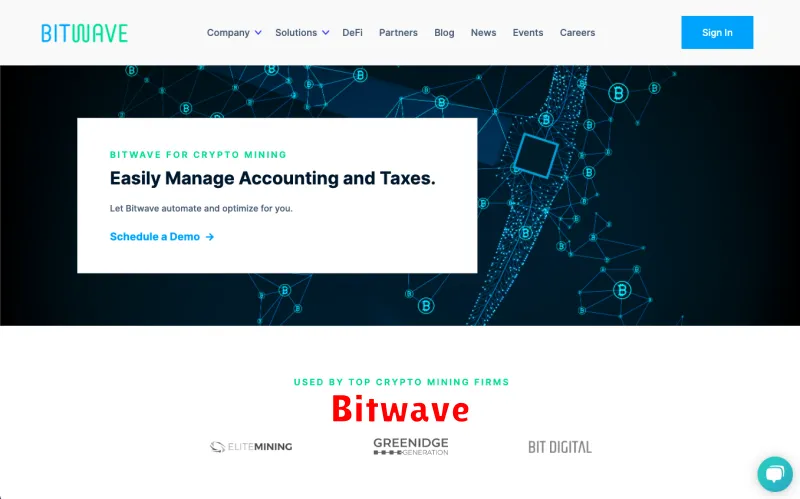

Bitwave

Bitwave is a powerful crypto tax software designed to simplify the complex process of tracking your cryptocurrency transactions for tax purposes. It boasts a user-friendly interface, making it accessible even to those without extensive accounting knowledge. A key feature is its ability to automatically import transaction data from various exchanges, saving you significant time and effort.

Bitwave offers robust reporting capabilities, generating comprehensive tax reports compliant with IRS regulations. This eliminates the need for manual calculations and reduces the risk of errors. Furthermore, their platform offers excellent customer support, ensuring you have assistance when needed to navigate the intricacies of crypto taxation.

While Bitwave offers a free plan for basic tracking, their paid plans unlock advanced features such as portfolio management tools and more detailed reporting options. It’s a solid choice for both individual investors and businesses involved in cryptocurrency trading, offering a streamlined approach to a notoriously complicated process.

Blox

Blox is a crypto tax software designed for ease of use and accuracy. It simplifies the often-complex process of tracking your crypto transactions by automatically importing data from various exchanges and wallets. This automation minimizes manual entry and the risk of errors.

A key feature of Blox is its ability to calculate your capital gains and losses across different cryptocurrencies, taking into account various tax rules and regulations. It offers support for a range of tax jurisdictions, making it a versatile option for international users. Its intuitive interface makes it suitable for both beginner and experienced crypto investors.

While Blox offers a free plan with limited features, its paid plans provide more comprehensive tracking capabilities and tax form generation. Consider Blox if you’re looking for a user-friendly solution that balances ease of use with robust reporting functionality. Remember to always consult with a qualified tax professional for personalized advice.