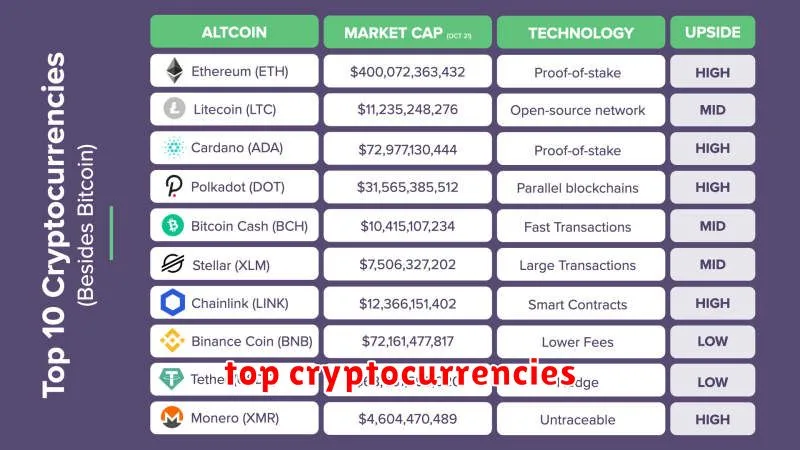

Ready to dive into the exciting world of cryptocurrency in 2024? This year promises to be a big one for crypto investments, with plenty of opportunities for both seasoned traders and newcomers alike. We’ve compiled a list of the Top 10 Cryptocurrencies to Watch in 2024, examining high-potential altcoins and established market leaders. Whether you’re interested in Bitcoin‘s continued dominance, the innovative technology behind Ethereum, or the disruptive potential of emerging blockchain projects, this guide will help you navigate the rapidly evolving cryptocurrency market and discover the best digital assets to add to your portfolio. Get ready to explore the future of finance!

Bitcoin (BTC)

Bitcoin (BTC) remains the undisputed king of cryptocurrencies. Despite market volatility, its first-mover advantage and established brand recognition solidify its position. In 2024, Bitcoin’s price will likely be influenced by macroeconomic factors like inflation and regulatory developments.

Keep an eye on Bitcoin’s halving event, scheduled for 2024, which historically leads to increased scarcity and potentially higher prices. While the exact price prediction is impossible, Bitcoin’s long-term potential remains significant for investors with a high-risk tolerance and long-term perspective. Its decentralized nature and limited supply continue to attract investors seeking alternative assets.

However, volatility remains a key concern. Investors should be prepared for potential price fluctuations and understand the risks involved before investing in Bitcoin. Its price action will depend heavily on broader market sentiment and regulatory clarity around cryptocurrencies globally.

Ethereum (ETH)

Ethereum remains a top contender in the crypto space. Its role as a leading platform for decentralized applications (dApps) and smart contracts continues to drive its value. The upcoming Shanghai upgrade, enabling withdrawals of staked ETH, is a significant catalyst for potential growth in 2024.

Key factors to watch include the continued development of the Ethereum ecosystem, the adoption of Layer-2 scaling solutions to improve transaction speed and reduce fees, and the overall market sentiment towards cryptocurrencies. The success of projects built on Ethereum will directly impact its price.

While volatility remains inherent in the crypto market, Ethereum’s established position and ongoing development make it a strong cryptocurrency to watch in 2024.

Binance Coin (BNB)

Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, one of the world’s largest cryptocurrency exchanges. Its value is intrinsically tied to the success and growth of the Binance ecosystem.

Key features driving BNB’s potential in 2024 include its utility in paying trading fees on the Binance platform, its use in accessing Binance’s decentralized finance (DeFi) offerings, and its role within the broader Binance Smart Chain (BSC) ecosystem. The ongoing development and expansion of BSC, with its increasing number of decentralized applications (dApps), continues to fuel demand for BNB.

However, risks exist. Regulatory scrutiny of cryptocurrency exchanges globally could impact Binance and, consequently, BNB’s price. Competition from other exchanges and blockchain networks also presents a challenge. Therefore, while BNB holds significant promise, investors should proceed with caution and conduct thorough research before investing.

Overall, BNB’s strong ties to a major player in the crypto market, coupled with its utility within the Binance ecosystem and the growing BSC, make it a cryptocurrency worthy of attention in 2024. Its future price will depend on several factors, including regulatory developments and the continued success of the Binance ecosystem.

Solana (SOL)

Solana is a high-performance blockchain known for its speed and scalability. It utilizes a novel consensus mechanism, called Proof of History, to achieve significantly faster transaction speeds compared to many other cryptocurrencies. This makes it attractive for decentralized applications (dApps) requiring quick and efficient processing.

In 2024, Solana will likely continue to attract developers and users. Its ecosystem is growing rapidly, with new projects and initiatives constantly emerging. However, it’s important to note that Solana has experienced network outages in the past, raising concerns about its reliability. Its performance and stability will be key factors to watch.

Key features to consider include its fast transaction speeds, low transaction fees, and vibrant developer community. Potential investors should carefully weigh these advantages against the risks associated with network stability and the volatility inherent in the cryptocurrency market. The overall success of Solana in 2024 will depend heavily on addressing past network issues and continuing to attract and retain developers building on its platform.

Polygon (MATIC)

Polygon (MATIC) is a Layer-2 scaling solution for Ethereum, aiming to improve transaction speeds and reduce costs. It’s a popular choice for developers building decentralized applications (dApps) due to its relatively low fees and fast transaction times compared to the Ethereum mainnet.

In 2024, Polygon’s continued development and adoption will be key factors to watch. Expansion of its ecosystem, including the integration of new projects and the growth of its decentralized finance (DeFi) applications, will significantly impact its value. Increased partnerships and collaborations with other major players in the crypto space could also boost MATIC’s price.

However, competition from other Layer-2 solutions and the overall market volatility remain potential challenges. The success of Polygon will depend heavily on its ability to maintain its technological edge and attract a large and active user base. Keeping an eye on its network activity, developer engagement, and overall market sentiment will provide crucial insights into its future performance.

Ripple (XRP)

Ripple (XRP) is a cryptocurrency designed for fast and low-cost international payments. Its primary use case revolves around its blockchain technology, which facilitates real-time gross settlement, currency exchange, and remittance systems.

In 2024, Ripple faces a significant legal battle with the Securities and Exchange Commission (SEC), which could significantly impact its price. A positive outcome could lead to a substantial price surge, given the large community and adoption potential. Conversely, a negative ruling could negatively impact its value.

Despite the legal uncertainty, Ripple’s technology continues to be adopted by financial institutions globally. Its scalability and speed make it a compelling alternative to traditional payment systems. Therefore, keeping an eye on Ripple’s legal proceedings and technological advancements is crucial for investors in 2024.

Key factors to watch include the outcome of the SEC lawsuit, the continued adoption of XRP by banks and payment providers, and any major technological updates.

Cardano (ADA)

Cardano (ADA) is a proof-of-stake blockchain platform known for its focus on academic research and peer-reviewed development. Its robust infrastructure and commitment to scalability make it a strong contender in the cryptocurrency space.

In 2024, Cardano is expected to continue its development with key upgrades focusing on improving transaction speed and efficiency. The community’s active involvement and ongoing projects, including smart contract functionality and decentralized applications (dApps), are significant factors to watch. Increased adoption of Cardano’s technology by businesses and developers will be crucial for its growth this year.

While price volatility remains a factor in the cryptocurrency market, Cardano’s strong fundamentals and commitment to innovation position it favorably for potential gains in 2024. However, potential investors should always conduct thorough research and understand the inherent risks before investing in cryptocurrencies.

Polkadot (DOT)

Polkadot is a layer-0 blockchain designed to connect various blockchains, allowing for interoperability and scalability. Its unique architecture enables different blockchains to communicate and share data seamlessly, overcoming a major limitation of many existing cryptocurrencies.

In 2024, Polkadot aims to further enhance its scalability and security features. Development continues on parachains, which are specialized blockchains built on Polkadot, providing a platform for diverse applications and potentially driving significant growth. The ongoing development and adoption of parachains are key factors to watch.

DOT, Polkadot’s native token, is essential for network governance and security. Increased adoption and usage of the Polkadot ecosystem could lead to a rise in DOT’s value. However, the cryptocurrency market is inherently volatile, and any investment carries risk.

Overall, Polkadot’s focus on interoperability and scalability positions it as a strong contender in the evolving cryptocurrency landscape. Its future performance will depend heavily on the success of its parachain ecosystem and broader market trends.

Avalanche (AVAX)

Avalanche (AVAX) is a smart contracts platform designed for high throughput and low latency. It aims to solve the scalability issues plaguing many other blockchain networks. Its unique consensus mechanism allows for fast transaction speeds and significantly lower fees compared to some competitors.

A key feature of Avalanche is its subnets, which allow for the creation of highly customized and scalable blockchains. This flexibility makes it attractive for various applications, including decentralized finance (DeFi), gaming, and NFTs.

In 2024, Avalanche’s focus on scalability and its robust ecosystem could drive growth. The platform’s ability to support a large number of decentralized applications (dApps) and its growing community are factors that could contribute to its success. However, the cryptocurrency market is inherently volatile, and investing always carries risk.

Watch for advancements in Avalanche’s technology and the expansion of its DeFi ecosystem in 2024. Increased adoption and partnerships could significantly impact its price.

Dogecoin (DOGE)

Dogecoin, the meme-inspired cryptocurrency, remains a significant player in the crypto market despite its origins. Its large and active community continues to drive significant trading volume and engagement.

While lacking the sophisticated technological underpinnings of some other cryptocurrencies, Dogecoin’s strong brand recognition and low transaction fees make it attractive to users. This, coupled with potential future developments and community initiatives, could lead to renewed interest and price growth in 2024.

However, investors should approach Dogecoin with caution. Its price is highly volatile and susceptible to market sentiment swings. It’s crucial to conduct thorough research and only invest what you can afford to lose.

Key factors to watch in 2024 include any major updates to its technology, community-driven initiatives, and overall market trends in the cryptocurrency space. Its future performance will depend on these factors and the continued engagement of its passionate community.