Looking for the best decentralized exchanges (DEXs) for your crypto trading needs? You’ve come to the right place! In today’s volatile market, choosing a secure and efficient DEX is crucial. We’ll dive into the top contenders, comparing their fees, security features, trading volume, and user experience to help you find the perfect platform for your crypto investments. Whether you’re a seasoned trader or just starting out, this guide will help you navigate the world of decentralized finance (DeFi) and discover the best DEX for your individual requirements. Get ready to explore the exciting world of decentralized exchanges!

Uniswap

Uniswap is a leading decentralized exchange (DEX) built on the Ethereum blockchain. Its popularity stems from its innovative automated market maker (AMM) model, which allows for seamless trading without relying on order books. This means users can trade tokens directly with a liquidity pool, providing greater liquidity and accessibility compared to centralized exchanges (CEXs).

The platform’s core strength lies in its decentralized nature. Unlike CEXs, Uniswap isn’t controlled by a single entity, offering users greater control over their funds and reducing the risk of censorship or single points of failure. This decentralization comes with the inherent benefit of increased security and transparency.

Uniswap V3, the latest iteration, introduced concentrated liquidity, enabling liquidity providers to focus their capital within specific price ranges, leading to higher capital efficiency and increased returns. While offering significant advantages, users should understand the complexities of AMMs and associated risks before engaging in trading.

Overall, Uniswap represents a significant advancement in decentralized finance (DeFi), offering a user-friendly and efficient platform for trading a wide range of ERC-20 tokens. Its robust design, security features, and community-driven development solidify its position as a top DEX.

PancakeSwap

PancakeSwap is a leading decentralized exchange (DEX) built on the Binance Smart Chain (BSC). Its popularity stems from its user-friendly interface, low transaction fees, and its ability to trade a wide variety of BEP-20 tokens.

One of PancakeSwap’s key features is its automated market maker (AMM) system, which allows for seamless trading without the need for order books. This contributes to its speed and efficiency. Users can also participate in yield farming and staking to earn passive income through various pools and farms.

While offering significant advantages, users should be aware of the risks associated with DEXs, including smart contract vulnerabilities and the potential for impermanent loss in liquidity pools. Despite these risks, PancakeSwap remains a prominent player in the decentralized finance (DeFi) ecosystem, providing a compelling platform for trading and earning cryptocurrencies.

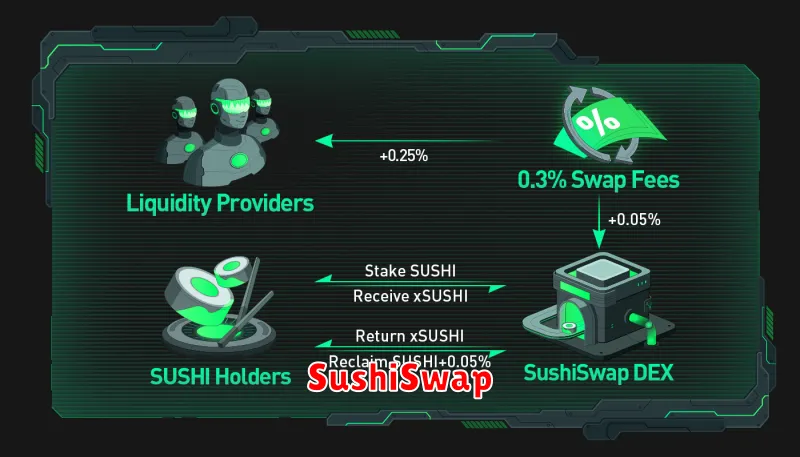

SushiSwap

SushiSwap is a leading decentralized exchange (DEX) built on the Ethereum blockchain. Known for its innovative features and community governance, it offers a compelling alternative to centralized exchanges.

One of SushiSwap’s key strengths is its automated market maker (AMM) model, allowing users to trade cryptocurrencies without relying on an order book. This facilitates fast and efficient transactions with minimal slippage.

Yield farming is another prominent feature. Users can stake their tokens in various liquidity pools to earn rewards, contributing to the platform’s liquidity and generating passive income. However, it’s crucial to understand the associated risks.

SushiSwap also boasts a robust governance system, empowering token holders to participate in shaping the platform’s future through voting on proposals.

While offering numerous advantages like low fees and permissionless trading, users should be aware of the inherent risks associated with DEXs, including smart contract vulnerabilities and the volatility of the cryptocurrency market.

Overall, SushiSwap remains a significant player in the DeFi ecosystem, providing a powerful and decentralized platform for cryptocurrency trading and yield generation, although due diligence is essential before participating.

Curve Finance

Curve Finance is a decentralized exchange (DEX) built on Ethereum, specializing in trading stablecoins and similar assets with minimal slippage. Unlike many DEXs that use automated market makers (AMMs) based on constant product formulas, Curve employs a more sophisticated algorithm optimized for low-slippage trades within a narrow price range. This makes it particularly efficient for swapping pegged assets.

Its key advantage lies in its low transaction costs and minimal slippage when trading similar assets. This is a significant improvement over traditional AMMs, especially beneficial for high-volume traders and arbitrageurs. The platform also boasts a strong and active community, which contributes to its security and liquidity.

However, Curve’s specialization limits its scope. It’s less suitable for trading assets with significant price volatility compared to more general-purpose DEXs. Additionally, while secure, it remains susceptible to vulnerabilities inherent in smart contracts, as all decentralized platforms are.

In summary, Curve Finance offers a compelling option for traders seeking low-slippage stablecoin and similar asset swaps. Its specialized approach provides efficiency and cost savings, making it a valuable addition to the decentralized finance (DeFi) ecosystem, but its niche focus should be considered before using it for broader trading needs.

Balancer

Balancer is a decentralized exchange (DEX) built on Ethereum that uses automated market makers (AMMs) to facilitate trading. Unlike traditional exchanges with order books, Balancer employs pools of liquidity provided by users. This allows for continuous trading 24/7 without the need for a centralized intermediary.

A key feature of Balancer is its support for arbitrary weighted pools. This means users can create pools with varying ratios of different tokens, allowing for greater flexibility and potentially more efficient pricing than exchanges with simpler, 50/50 pools. This is particularly useful for managing risk and exposure to different assets within a portfolio.

Liquidity providers (LPs) on Balancer earn fees generated from trades within their respective pools. The amount of fees earned is proportional to their share of the pool’s liquidity. However, LPs are also exposed to impermanent loss, a risk associated with AMMs where the value of their deposited assets can fluctuate compared to holding them individually.

Balancer offers a diverse range of governance tokens and features that allows users to participate in the platform’s decision-making processes. It also supports a variety of different blockchain networks, expanding its accessibility and utility for users.

Overall, Balancer stands out for its sophisticated pool management capabilities and its emphasis on community governance. While impermanent loss remains a consideration for liquidity providers, the potential for high yields and the flexibility of weighted pools make it a compelling option for those seeking a decentralized trading experience.

1Inch Network

1Inch Network is an aggregator of decentralized exchanges (DEXs). Instead of using a single DEX, 1Inch searches across multiple platforms like Uniswap, SushiSwap, and others to find the best available price for your trade. This helps users achieve optimal pricing and slippage.

Its strength lies in its ability to compare prices from various DEXs in real-time, ensuring users always get the most favorable exchange rates. This significantly reduces the impact of price discrepancies that can occur across different platforms.

Beyond price aggregation, 1Inch offers a user-friendly interface and supports various functionalities including limit orders and meta transactions, making the overall trading experience more convenient. This makes it a powerful tool for users seeking the best possible deals in the decentralized finance (DeFi) ecosystem.

While 1Inch doesn’t operate a DEX itself, its innovative aggregation technology offers a compelling advantage for traders looking for the best possible execution and price. This focus on efficiency and user experience solidifies its position as a leading player in the DeFi landscape.

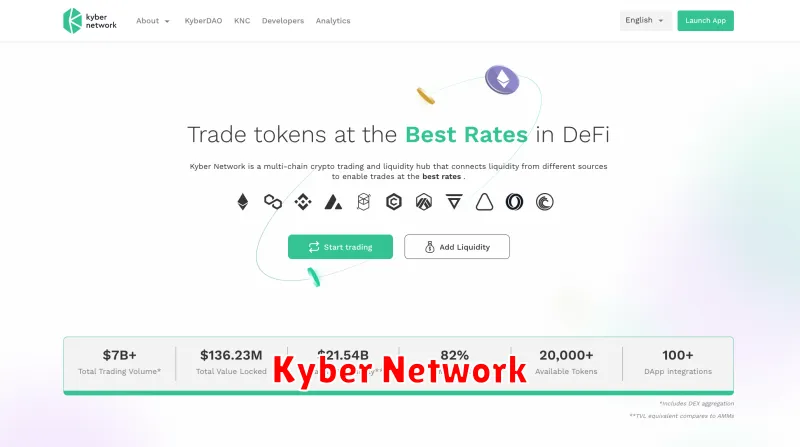

Kyber Network

Kyber Network is a decentralized exchange (DEX) built on the Ethereum blockchain. It utilizes a on-chain liquidity protocol, allowing for seamless token swaps without the need for a centralized order book. This differentiates it from many other DEXs, offering a more decentralized and potentially faster trading experience.

Key features of Kyber Network include its wide range of supported tokens, relatively low slippage (the difference between the expected price and the actual price of a trade), and its integration with various wallets and applications. The network’s liquidity is aggregated from various sources, enhancing trading efficiency and reducing the impact of single points of failure.

However, Kyber Network’s fees can sometimes be higher than some competing DEXs, and the trading volume might be less than some of the larger, more established platforms. It’s crucial to compare fees and liquidity across different DEXs before making a trading decision.

Overall, Kyber Network presents a viable option for users seeking a decentralized, relatively efficient, and widely integrated trading experience. Its unique on-chain liquidity protocol contributes to its distinct position in the DeFi landscape. Users should, however, carefully weigh its pros and cons against other DEX options to determine the best fit for their specific trading needs.

dYdX

dYdX is a leading decentralized exchange (DEX) built on the Ethereum blockchain. It’s known for its focus on perpetual contracts and margin trading, offering leverage to amplify trading gains (and losses). This makes it popular with more experienced traders looking for advanced trading strategies.

A key advantage of dYdX is its high liquidity, ensuring traders can easily enter and exit positions. It also boasts a robust order book, providing transparency and depth. However, the platform’s complexity can be a barrier for entry for novice crypto traders. The interface, while powerful, requires familiarity with advanced trading concepts.

Security is a primary concern for any DEX, and dYdX employs various measures to protect user funds. While no system is perfectly secure, it maintains a strong reputation in the crypto community. Smart contract audits are crucial, and users should always research the security measures a platform employs before trading significant assets.

Overall, dYdX provides a powerful and feature-rich trading experience for users comfortable navigating its advanced features. Its strength lies in the professional trading tools it offers, but its complexity means it’s not ideal for beginners.

QuickSwap

QuickSwap is a decentralized exchange (DEX) built on the Polygon network. This makes it a strong contender among the best DEXs due to its significantly lower transaction fees compared to Ethereum-based DEXs. It boasts a user-friendly interface and offers a wide range of Polygon-based tokens for trading.

One of QuickSwap’s key advantages is its speed. Transactions are processed much faster than on Ethereum, leading to a smoother and more efficient trading experience. The platform also implements a liquidity provision system allowing users to earn passive income by contributing liquidity to trading pairs.

While offering many benefits, potential users should be aware of the risks inherent in decentralized finance (DeFi). Smart contract vulnerabilities and market volatility are ever-present concerns. Users should always conduct their own research (DYOR) and only invest what they can afford to lose.

Overall, QuickSwap provides a compelling alternative for traders seeking a fast, low-cost, and user-friendly DEX experience within the Polygon ecosystem. Its speed and accessibility make it a noteworthy option in the world of decentralized crypto trading.

Bancor

Bancor is a decentralized exchange (DEX) protocol known for its automated market maker (AMM) system. Unlike traditional order-book exchanges, Bancor uses smart contracts to facilitate trades, eliminating the need for intermediaries.

A key feature of Bancor is its “relational pools”. These pools allow for trading between a wide range of cryptocurrencies, often with pairs not found on other DEXs. This provides users with increased liquidity and more trading options.

Bancor’s emphasis on liquidity provision makes it attractive for users looking to earn passive income. Users can stake their tokens in these pools and earn trading fees, generating a return on their investment. However, it’s crucial to understand the risks associated with impermanent loss, where the value of your staked assets may decrease compared to holding them directly.

While offering strong liquidity and a vast range of trading pairs, Bancor’s fees can sometimes be higher than other DEXs. This is a factor to consider when choosing your preferred exchange.

Overall, Bancor is a significant player in the decentralized exchange space, providing a unique approach to trading and liquidity provision. Its innovative AMM system and wide token support make it a valuable tool for crypto traders, though careful consideration of its fee structure and impermanent loss risk is essential.