Dive into the exciting world of Decentralized Finance (DeFi)! This beginner-friendly guide will demystify the basics of DeFi, explaining what it is, how it works, and why it’s revolutionizing the financial landscape. Learn about key concepts like cryptocurrency, smart contracts, blockchain technology, and decentralized exchanges (DEXs). Discover the potential benefits and risks of participating in the DeFi ecosystem, and unlock the opportunities available to you in this innovative and rapidly evolving space. Get ready to explore the future of finance!

What is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, is a rapidly growing sector that aims to rebuild the traditional financial system using blockchain technology. Instead of relying on central intermediaries like banks or payment processors, DeFi leverages smart contracts and distributed ledger technology to offer a range of financial services.

Think of it as a peer-to-peer financial ecosystem. Transactions are executed directly between participants, eliminating the need for trusted third parties and potentially reducing costs and increasing transparency. This decentralized nature is what gives DeFi its name and its core appeal.

Key services offered within the DeFi space include lending and borrowing, trading, stablecoins, and yield farming. These services are accessible to anyone with an internet connection and a cryptocurrency wallet, regardless of their geographic location or financial background. However, it’s crucial to remember that risks are inherent in this nascent technology, including smart contract vulnerabilities and price volatility.

Ultimately, DeFi represents a significant shift in how financial services are delivered, promising a more inclusive, transparent, and efficient system. However, it’s still an evolving landscape, and understanding its intricacies is crucial before participation.

The Role of DeFi in Crypto Ecosystems

Decentralized Finance (DeFi) plays a crucial role in expanding and enhancing the capabilities of cryptocurrency ecosystems. It acts as a bridge, connecting traditional financial services with the decentralized, blockchain-based world.

DeFi’s primary function is to offer alternative financial services without relying on intermediaries like banks or other centralized institutions. This fosters a more inclusive and accessible financial system, especially in regions with limited access to traditional banking.

Key aspects of DeFi’s role include providing platforms for lending and borrowing crypto assets (without needing a bank), facilitating decentralized exchanges (DEXs) for trading cryptocurrencies peer-to-peer, and enabling the creation and trading of other financial instruments like stablecoins and derivatives.

Furthermore, DeFi fosters innovation within the crypto space. By providing open-source protocols and smart contracts, it encourages the development of new financial products and services, leading to increased competition and potentially lower costs for users.

However, it’s important to note that DeFi also presents risks, including smart contract vulnerabilities, security breaches, and the inherent volatility of cryptocurrency markets. Understanding these risks is crucial before engaging with DeFi platforms.

In essence, DeFi is transforming the crypto landscape by providing a decentralized, transparent, and often more efficient alternative to traditional finance. Its continued development and adoption are poised to significantly shape the future of the cryptocurrency ecosystem.

Top DeFi Platforms for Beginners

Navigating the world of Decentralized Finance (DeFi) can feel overwhelming for newcomers. Luckily, several platforms offer user-friendly interfaces and streamlined experiences, perfect for beginners.

Aave is a popular choice, known for its straightforward lending and borrowing protocols. You can earn interest on deposited crypto or borrow funds at competitive rates. Its intuitive design makes it accessible even without extensive technical knowledge.

Compound is another excellent platform for lending and borrowing. Similar to Aave, it provides a relatively easy-to-use interface and a range of supported cryptocurrencies. Understanding the risk involved with lending and borrowing is crucial before using this or any DeFi platform.

Uniswap is a leading decentralized exchange (DEX) that allows you to swap various cryptocurrencies without intermediaries. While its interface might seem slightly more complex than lending platforms, numerous tutorials and resources are available to guide beginners.

Curve Finance is a DEX specializing in stablecoin trading. Stablecoins maintain a relatively stable value compared to other cryptocurrencies, making Curve a good option for beginners who want to minimize volatility. Its focus on a specific type of asset simplifies the trading experience.

Remember, the DeFi space is constantly evolving. Always conduct thorough research, understand the risks associated with each platform, and only invest what you can afford to lose. Consider starting with smaller amounts to gain experience before making larger investments.

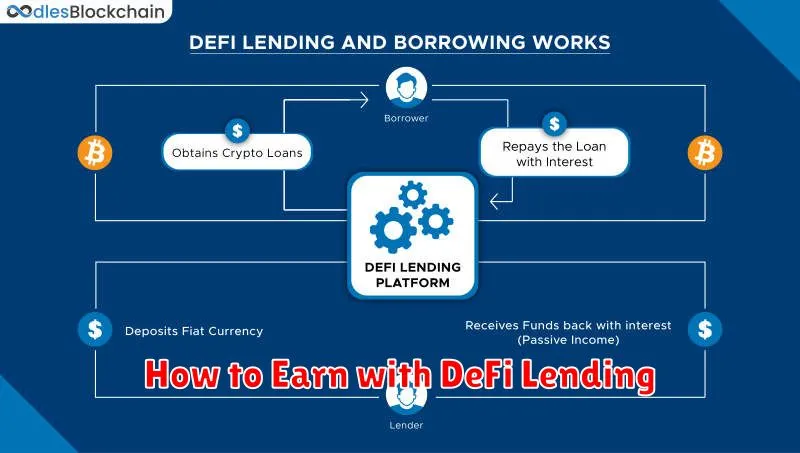

How to Earn with DeFi Lending

DeFi lending allows you to earn passive income by lending out your cryptocurrencies to borrowers. It’s a core component of the decentralized finance (DeFi) ecosystem. Instead of holding your assets idly, you can put them to work and earn interest.

The process typically involves depositing your crypto into a DeFi lending platform. These platforms act as intermediaries, matching lenders like you with borrowers needing funds. You earn interest based on the amount you lend and the platform’s interest rate, which varies depending on market conditions and the cryptocurrency you’re lending.

Interest rates in DeFi lending can be significantly higher than traditional savings accounts, offering attractive returns. However, it’s crucial to understand the risks involved, such as smart contract vulnerabilities, platform risks, and the volatility of cryptocurrencies themselves.

Before engaging in DeFi lending, thoroughly research different platforms. Consider factors such as their reputation, security measures, Annual Percentage Yield (APY) offered, and the types of cryptocurrencies supported. Diversifying your lending across multiple platforms can help mitigate risk.

Always remember that DeFi lending involves risks, and you could lose some or all of your invested assets. Only invest what you can afford to lose. Understanding the risks and carefully researching platforms is paramount before participating in this aspect of the DeFi ecosystem.

Staking and Yield Farming Explained

Staking and yield farming are two popular ways to earn passive income in the world of decentralized finance (DeFi). Both involve locking up your cryptocurrencies to receive rewards, but they differ in their mechanics and risk levels.

Staking is essentially locking your cryptocurrency to support the security and operations of a blockchain network. Think of it as “renting out” your coins. In return, you earn rewards in the form of more of the same cryptocurrency or a governance token. Staking is generally considered a relatively low-risk activity, as it often involves established and well-known blockchains.

Yield farming, on the other hand, is a more advanced and riskier strategy. It involves lending your crypto to decentralized finance (DeFi) platforms like Aave or Compound, or providing liquidity to decentralized exchanges (DEXs) like Uniswap. You earn rewards in the form of interest, often paid in a variety of tokens. The higher yields often come with greater risks, including impermanent loss (the loss incurred when the price of assets in a liquidity pool changes significantly).

The key difference lies in the complexity and risk: staking is simpler and generally safer, while yield farming offers higher potential returns but comes with increased risks. Before participating in either, thoroughly research the platform and understand the associated risks. Never invest more than you can afford to lose.

Risks to Watch Out for in DeFi

Decentralized finance (DeFi) offers exciting opportunities, but it also carries significant risks. Understanding these risks is crucial before participating.

Smart Contract Risks: Smart contracts, the backbone of DeFi, are computer programs. Bugs or vulnerabilities in their code can be exploited, leading to the loss of funds. Audits help mitigate this, but no system is foolproof.

Rug Pulls and Exit Scams: DeFi projects can be easily launched anonymously. Unscrupulous developers can create a project, attract investors, and then disappear with the funds (a rug pull). Thorough research and due diligence are essential.

Impermanent Loss (IL): Providing liquidity in decentralized exchanges (DEXs) can lead to impermanent loss. This occurs when the price of assets in a liquidity pool changes significantly, resulting in less value than if you had simply held the assets.

Hacking and Exploits: DeFi protocols are targets for hackers. Exploits can drain funds from protocols or users’ wallets. The decentralized nature can make recovering stolen funds difficult.

Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving. Changes in regulations could impact the accessibility and legality of various DeFi activities.

Volatility: The cryptocurrency market is highly volatile. The value of your DeFi investments can fluctuate significantly, leading to substantial gains or losses.

Lack of Consumer Protection: Unlike traditional finance, DeFi lacks robust consumer protection mechanisms. If something goes wrong, recovering your funds can be challenging.

User Error: Many DeFi interactions involve using complex interfaces and managing private keys. Mistakes in handling these can lead to irreversible loss of funds.

The Future of DeFi and Its Impact on Finance

The future of Decentralized Finance (DeFi) is brimming with potential. As the technology matures and adoption grows, we can expect to see a significant impact on traditional finance.

One key area is increased financial inclusion. DeFi’s permissionless nature allows individuals previously excluded from traditional banking systems to access financial services. This could revolutionize access to credit, savings, and investment opportunities in underserved communities globally.

We can also anticipate greater efficiency and transparency. Smart contracts automate processes, reducing intermediaries and the associated costs and delays. The transparent nature of blockchain technology enhances accountability and trust.

However, the future also presents challenges. Scalability remains a key issue, as high transaction volumes can lead to network congestion. Regulation is another crucial aspect; clear and consistent regulatory frameworks are needed to ensure responsible innovation and protect users.

Furthermore, security is paramount. While blockchain technology is inherently secure, smart contracts are susceptible to vulnerabilities. Rigorous auditing and security best practices are essential to mitigate risks.

Ultimately, DeFi’s impact on finance will depend on how these challenges are addressed. If the sector successfully navigates these hurdles, it has the potential to reshape the financial landscape, making it more inclusive, efficient, and transparent.