So you want to learn how to start trading crypto? The world of cryptocurrency can seem daunting for beginners, with its volatile markets and complex terminology. But don’t worry! This beginner’s guide will walk you through the essential steps to start trading cryptocurrencies safely and effectively. We’ll cover everything from choosing the right crypto exchange and understanding crypto trading strategies to managing your crypto portfolio and mitigating risks. Get ready to unlock the potential of Bitcoin, Ethereum, and other exciting digital assets – let’s dive into the exciting world of crypto trading!

Understanding the Basics of Cryptocurrency

Before diving into cryptocurrency trading, it’s crucial to grasp the fundamentals. At its core, cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. Unlike traditional currencies issued and controlled by central banks, cryptocurrencies utilize cryptography for security and operate on a decentralized network, typically a blockchain.

Blockchain technology is a key element. It’s a distributed, public ledger recording every transaction, making it transparent and highly secure. Each transaction is grouped into “blocks,” which are then linked together chronologically and cryptographically secured, hence the name “blockchain.”

Bitcoin, the first and most well-known cryptocurrency, serves as a prime example. However, thousands of other cryptocurrencies, often called altcoins, exist, each with its unique features and purposes. Some focus on faster transaction speeds, others on enhanced privacy, and still others on specific applications like decentralized finance (DeFi).

Understanding the decentralized nature of cryptocurrencies is paramount. This means no single entity, like a government or bank, controls them. This decentralization is a significant advantage for many, offering resistance to censorship and control. However, it also means increased responsibility for the user to manage their own digital assets securely.

Finally, volatility is an inherent characteristic of cryptocurrencies. Their prices can fluctuate dramatically in short periods, presenting both significant opportunities and considerable risks. Understanding this volatility is essential before participating in the crypto market.

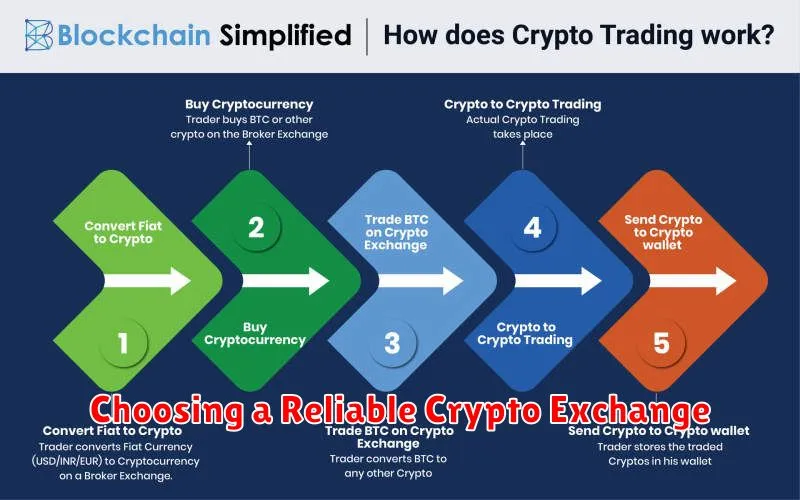

Choosing a Reliable Crypto Exchange

Choosing the right cryptocurrency exchange is a crucial first step for any beginner. A reliable exchange will protect your funds and offer a user-friendly platform. Don’t rush this decision!

Consider these key factors: security, fees, available cryptocurrencies, and user interface. Research thoroughly before depositing any funds.

Security is paramount. Look for exchanges with robust security measures, including two-factor authentication (2FA), cold storage for a significant portion of their assets, and a proven track record of protecting user funds. Read reviews and check for any history of hacks or security breaches.

Fees vary widely between exchanges. Compare trading fees, deposit fees, and withdrawal fees to find the most cost-effective option for your trading volume and preferred cryptocurrencies. Be aware of hidden fees.

The range of available cryptocurrencies is another important factor. Ensure the exchange lists the digital assets you’re interested in trading. Some exchanges specialize in specific cryptocurrencies, while others offer a broader selection.

Finally, a user-friendly interface is essential, especially for beginners. Choose an exchange with an intuitive design that’s easy to navigate and understand. A confusing interface can lead to mistakes and frustration.

Taking the time to research and compare different exchanges will help you find a platform that suits your needs and minimizes your risk. Remember, your funds are at stake, so due diligence is crucial.

Setting Up Your Trading Account

Before you can start trading cryptocurrencies, you need to set up a trading account with a reputable exchange. Choosing the right exchange is crucial; consider factors like fees, security measures, and the availability of the cryptocurrencies you want to trade.

The signup process usually involves providing your personal information, such as your name, email address, and potentially a government-issued ID for verification purposes (Know Your Customer or KYC regulations). You’ll also need to create a strong and secure password.

Most exchanges require you to enable two-factor authentication (2FA), adding an extra layer of security to your account. This usually involves using an authenticator app on your smartphone to generate a unique code each time you log in.

Once your account is verified, you can deposit funds. Exchanges typically support various payment methods, including bank transfers, credit/debit cards, and sometimes even cryptocurrency itself. Remember to carefully review the deposit fees before proceeding.

After funding your account, you’re ready to start exploring the different cryptocurrencies available for trading. Familiarize yourself with the exchange’s interface and trading tools before making any actual trades. Start small and only invest what you can afford to lose.

Learning Different Trading Strategies

Before diving into the crypto market, understanding different trading strategies is crucial. Choosing the right strategy aligns with your risk tolerance, investment goals, and available time.

Day trading involves buying and selling cryptocurrencies within a single day, aiming to profit from short-term price fluctuations. This requires constant market monitoring and a high risk tolerance.

Swing trading holds positions for a few days or weeks, capitalizing on medium-term price swings. It demands less time commitment than day trading but still necessitates careful market analysis.

Long-term investing (HODLing) involves buying and holding cryptocurrencies for extended periods, often years, expecting significant price appreciation over time. This strategy requires patience and a long-term perspective.

Scalping is an extremely short-term strategy focusing on tiny price changes, requiring quick execution and high trading volume. It’s very risky and demands significant expertise.

Arbitrage exploits price differences for the same cryptocurrency across different exchanges. It requires quick action and access to multiple platforms.

Learning about these strategies is just the first step. Backtesting your chosen strategy using historical data and paper trading (simulating trades with virtual money) are vital before risking real capital. Remember, risk management is paramount in any trading strategy.

The Importance of Risk Management in Trading

Risk management is paramount in cryptocurrency trading, even more so than in traditional markets due to the inherent volatility of cryptocurrencies. It’s not about avoiding risk entirely – that’s impossible – but about controlling and mitigating it.

Without proper risk management, even a single bad trade can wipe out your entire investment. A solid strategy involves defining your risk tolerance – how much you’re willing to lose on any given trade or investment – and sticking to it. This often translates to setting stop-loss orders to automatically sell an asset if it drops to a predetermined price, limiting potential losses.

Diversification is another crucial aspect. Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies to reduce the impact of any single asset’s price fluctuation. This helps to balance out potential losses.

Position sizing is also critical. Never invest more than you can afford to lose on a single trade. Even with a well-defined risk tolerance, over-leveraging or investing too much in a single position significantly amplifies your risk.

Finally, consistent monitoring and regular review of your trading strategies are essential. The crypto market is dynamic; what worked yesterday may not work today. Regularly evaluate your performance, adjust your strategies as needed, and learn from your mistakes. Discipline and patience are key components of successful risk management in any market.

Tracking Crypto Market Trends

Before diving into crypto trading, understanding market trends is crucial. Consistent monitoring is key to making informed decisions.

Several resources can help you track these trends. Reliable cryptocurrency news websites and financial news outlets provide up-to-date information on market movements. These sources often offer analysis from experts, helping you interpret the data.

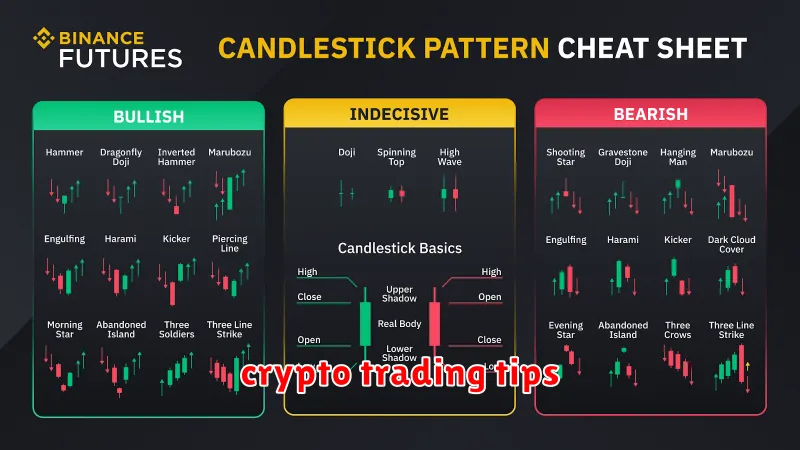

Charting tools are invaluable. Platforms like TradingView offer various charts displaying historical and real-time data, enabling you to identify patterns and potential trends. Learn to interpret candlestick charts, moving averages, and other technical indicators.

Social media can offer a pulse of sentiment, but use caution. While it can reveal widespread excitement or fear, it’s also susceptible to manipulation. Don’t rely solely on social media for trading decisions.

Finally, remember that no prediction is foolproof. Crypto markets are highly volatile. Track trends to gain insights, but always manage your risk responsibly.

Common Mistakes to Avoid in Crypto Trading

Entering the world of crypto trading can be exciting, but it’s crucial to avoid common pitfalls that can lead to significant losses. One of the biggest mistakes is emotional trading. Let your research and strategy, not your feelings, guide your decisions. Avoid impulsive buys or sells based on fear or greed.

Another frequent error is ignoring market research. Before investing in any cryptocurrency, thoroughly research its underlying technology, use case, and market trends. Understanding the project’s fundamentals is key to making informed investment choices. Don’t just follow the hype; do your due diligence.

Diversification is vital. Don’t put all your eggs in one basket. Spreading your investments across various cryptocurrencies reduces the risk associated with the volatility of any single asset. A well-diversified portfolio can help mitigate losses if one investment underperforms.

Many beginners fall prey to FOMO (Fear Of Missing Out). This leads to rash decisions and potentially poor investments. Remember that patience is crucial in crypto trading. There will always be opportunities; rushing into a trade just because it’s trending is a recipe for disaster.

Finally, never invest more than you can afford to lose. Cryptocurrency markets are highly volatile; losses are possible. Proper risk management is paramount to a successful and sustainable trading strategy. Only invest what you’re comfortable losing and manage your positions accordingly.

Tips for Long-Term Investment in Cryptocurrency

Investing in cryptocurrency for the long term requires a different approach than short-term trading. Patience is key. The market is volatile, and short-term fluctuations are normal. Don’t panic sell during dips; instead, view them as potential buying opportunities.

Diversification is crucial. Don’t put all your eggs in one basket. Invest in a variety of cryptocurrencies, spreading your risk across different projects and technologies. Research thoroughly before investing in any particular coin.

Dollar-cost averaging (DCA) is a smart strategy. Instead of investing a lump sum, invest smaller amounts regularly over time. This mitigates the risk of buying high and helps to smooth out market volatility.

Fundamental analysis is important. Don’t just follow hype. Understand the underlying technology, the team behind the project, and its potential use cases. Look for projects with strong fundamentals and a clear roadmap.

Security should be your top priority. Use reputable exchanges and wallets, and always enable two-factor authentication (2FA). Securely store your private keys and be wary of phishing scams.

Long-term investing requires research and discipline. Stay informed about market trends and technological developments, but don’t let emotions dictate your investment decisions. Regularly review your portfolio and adjust your strategy as needed, but avoid impulsive actions based on short-term price movements.

Consider your risk tolerance. Cryptocurrency investments carry significant risk. Only invest what you can afford to lose, and never invest borrowed money. A well-defined investment strategy aligned with your financial goals and risk appetite is crucial for long-term success.