Are you a student studying in the U.S. and looking for ways to manage your finances effectively? In this article, we will provide you with essential budgeting and saving tips specially tailored for students. By implementing these strategies, you will be able to take control of your expenses, save money, and build a strong financial foundation during your time in college.

Creating a Realistic Budget

In this article, we will discuss the importance of creating a realistic budget for students in the U.S. and provide helpful tips to effectively manage their finances.

1. Assess Your Income and Expenses

The first step in creating a realistic budget is to determine your sources of income and calculate your monthly expenses. Track your spending habits and identify areas where you can cut costs.

2. Set Financial Goals

Establishing financial goals can help you stay motivated and focused. Whether it’s saving for tuition fees, paying off student loans, or building an emergency fund, clearly define your objectives and allocate funds accordingly.

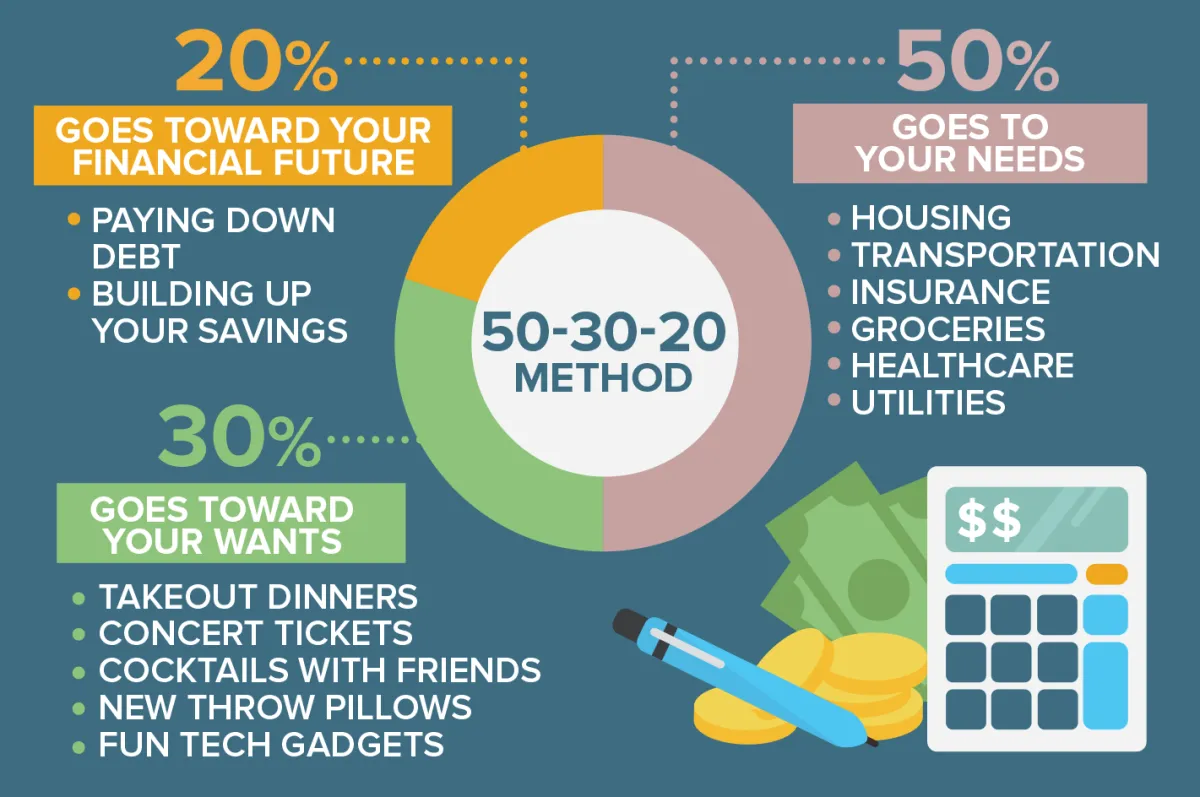

3. Prioritize Essential Expenses

Make a list of essential expenses such as rent, utilities, groceries, and transportation. Prioritize these expenses and set aside enough money to cover them each month before allocating funds for discretionary spending.

4. Avoid Credit Card Debt

While credit cards can be convenient, it’s important to use them responsibly. Avoid accumulating credit card debt by paying your bills on time and in full each month. Consider using cash or debit cards instead to limit unnecessary spending.

5. Look for Ways to Save

Find ways to cut costs and save money. This can include buying used textbooks, using public transportation, cooking meals at home, and taking advantage of student discounts. Small savings can add up over time.

6. Track Your Expenses

Keep track of your expenses regularly to ensure you are staying within your budget. Use budgeting apps or create spreadsheets to monitor your spending and make adjustments when necessary.

7. Be Flexible

Life can be unpredictable, and financial situations may change. Stay flexible with your budget and be prepared to adjust it as needed. This will help you adapt to unexpected expenses or changes in your income.

8. Seek Financial Education

Take advantage of financial education resources available to students. Attend workshops, seminars, or utilize online tools that can enhance your understanding of personal finance and help you make informed decisions.

By following these tips and creating a realistic budget, students in the U.S. can gain control over their finances, reduce stress, and work towards achieving their financial goals.

Saving Money on Textbooks and Supplies

When it comes to college expenses, textbooks and supplies can quickly eat into your budget. However, there are several ways for students in the U.S. to save money in this area:

1. Buy Used or Rent Textbooks

Instead of buying brand new textbooks, consider purchasing used copies or renting them. Many college bookstores offer used options at a lower cost, and there are also online platforms where you can buy or rent textbooks at discounted prices.

2. Check the Library

Before purchasing a textbook, check if it’s available at your college library. Often, they will have copies that you can borrow for a certain period of time. This can be a great way to save money, especially for books that you won’t need for the long term.

If a particular textbook is required for a class, consider splitting the cost with classmates. You can take turns using the book or even arrange study sessions together. Sharing the expense can significantly reduce your individual spending on textbooks.

4. Look for Digital Versions

Many textbooks are now available in digital formats, which are often cheaper than printed versions. Check if the publisher offers electronic copies or if there are online platforms where you can purchase or rent e-books. Just make sure you have a device compatible with reading digital textbooks.

5. Buy Only Essential Supplies

When it comes to supplies like notebooks, pens, and other stationery items, make a list of the essentials you really need. Avoid unnecessary purchases and focus on practicality. Consider buying in bulk or waiting for sales to get the best deals.

By implementing these strategies, you can save a significant amount of money on textbooks and supplies while still having everything you need for your studies.

Utilizing Student Discounts

Being a student in the U.S. can be financially challenging, but there are several ways to save money and stretch your budget. One of the most effective strategies is to take advantage of the various student discounts available. These discounts are offered by businesses and organizations exclusively to students, allowing them to enjoy special deals and lower prices on a wide range of products and services.

1. Student ID

First and foremost, make sure to always carry your student ID with you. Many retailers, restaurants, and entertainment venues require a valid student ID to grant access to exclusive discounts. By having your student ID readily available, you can easily take advantage of these offers wherever you go.

2. Online Discounts

In addition to physical stores, numerous online platforms provide student discounts. Websites like UNiDAYS and Student Beans offer free memberships for students, granting them access to exclusive online deals. Just sign up with your student email address to unlock a variety of discounts on clothing, tech gadgets, travel, and more.

3. Local Discounts

Explore your local area to discover the student discounts available nearby. Many businesses, including cafes, cinemas, museums, and gyms, offer special rates for students. Take the time to research and inquire about these discounts, as they can significantly reduce your expenses while still allowing you to enjoy leisure activities.

4. Transportation

If you rely on public transportation or frequently travel, be sure to check if there are any discounted fares or student passes available. Public transportation systems in various cities and regions often offer reduced rates for students. This can save you a significant amount of money on your daily commute or when exploring new places.

5. Subscriptions and Services

Many popular subscription services, such as streaming platforms and software providers, offer discounted rates for students. You can find discounted subscriptions for music streaming, video streaming, and even software packages essential for your studies. Take advantage of these offers to save money on entertainment and useful tools.

By utilizing student discounts, you can make your money go further as a student in the U.S. These exclusive offers make it easier to manage your finances and enjoy various products and services without breaking the bank. Remember to always inquire about student discounts wherever you go, as you never know what deals you might uncover!

Financial Aid and Scholarship Opportunities

When it comes to budgeting and saving as a student in the U.S., exploring financial aid and scholarship opportunities can greatly alleviate the burden. Financial aid includes grants, loans, and work-study programs offered by colleges and universities, while scholarships are monetary awards given based on various criteria.

Applying for financial aid should be a priority for every student. Start by completing the Free Application for Federal Student Aid (FAFSA) to access government funding. Additionally, many institutions offer their own aid programs, so it’s crucial to research and apply for all possible options.

Scholarships are a valuable resource for students looking to offset educational expenses. They can be merit-based, need-based, or awarded for specific talents or affiliations. Research online scholarship databases, check with your school’s financial aid office, and reach out to local organizations and companies for potential opportunities.

Remember to pay attention to application deadlines and requirements. Keeping track of important dates and submitting applications early can increase your chances of receiving aid or scholarships. It’s also essential to maintain good academic standing and meet any renewal criteria for ongoing financial support.

Financial aid and scholarships can significantly reduce the financial burden of education in the U.S. Take advantage of these opportunities, as they can make a significant difference in your ability to budget and save while pursuing your academic goals.

Conclusion

In conclusion, implementing effective budgeting and saving strategies is crucial for students in the U.S. It helps them manage their finances, avoid debt, and build a strong foundation for their future. By prioritizing needs over wants, tracking expenses, and seeking opportunities for saving, students can achieve financial stability and success.