Are you an international student planning to study in Canada? It’s important to understand the ins and outs of budgeting as you navigate financial planning in a new country. In this article, we will explore the essential tips and strategies for managing your finances effectively as an international student in Canada.

Understanding the cost of living in Canada

In this article, we will delve into the cost of living in Canada, specifically focusing on financial planning for international students. Living expenses can vary across different provinces and cities, so it’s essential to have a clear understanding of the costs involved to effectively manage your budget.

Tuition Fees

One of the major expenses for international students in Canada is tuition fees. These fees can vary depending on the program, university, and your residency status. It is crucial to research and compare the tuition costs of different institutions before making a decision.

Accommodation

Another significant cost to consider is accommodation. Rent prices vary depending on the city and type of housing. Options include on-campus dormitories, off-campus apartments, or homestays. It’s advisable to explore different housing options and determine which one fits your budget and preferences.

Transportation

Transportation costs are an integral part of your living expenses. Canadian cities have reliable public transportation systems, but there can still be expenses associated with commuting. Familiarize yourself with the local transportation options, such as buses, trains, or metros, and budget accordingly.

Food and Grocery

Food expenses can vary depending on your diet and lifestyle choices. Cooking your meals at home can help save money compared to eating out regularly. Additionally, explore local grocery stores and markets for affordable options. It’s essential to create a realistic budget for your food expenses.

Health Insurance

International students are typically required to have health insurance while studying in Canada. The cost of health insurance can vary, so it’s crucial to understand the coverage and associated expenses. Research different insurance providers to find the best option for your needs.

Other Expenses

In addition to the major expenses mentioned above, it’s important to consider other miscellaneous costs like textbooks, school supplies, mobile phone plans, internet bills, and entertainment. These expenses can add up, so it’s essential to include them in your budget planning.

By understanding the cost of living in Canada and having a detailed financial plan, international students can effectively manage their budget during their stay. Planning ahead, researching expenses, and making informed choices will contribute to a successful and financially stable experience in Canada.

Creating a budget and managing expenses

When it comes to budgeting in Canada as an international student, it is crucial to have a solid financial plan in place. Managing your expenses effectively is essential for a successful and stress-free academic experience. Here are some key tips to help you create a budget and manage your expenses:

1. Track your income and expenses

Start by keeping a record of your income and expenses. This will give you a clear picture of where your money is coming from and where it is going. Take note of all your sources of income, such as scholarships, part-time jobs, or financial support from your family. Similarly, keep track of your expenses, including tuition fees, rent, groceries, transportation, and other miscellaneous costs.

2. Set financial goals

Establishing financial goals can help you stay focused and motivated. Determine what you want to achieve financially during your time in Canada. Whether it is saving for tuition fees, covering living expenses, or building an emergency fund, having clear goals will guide your budgeting decisions.

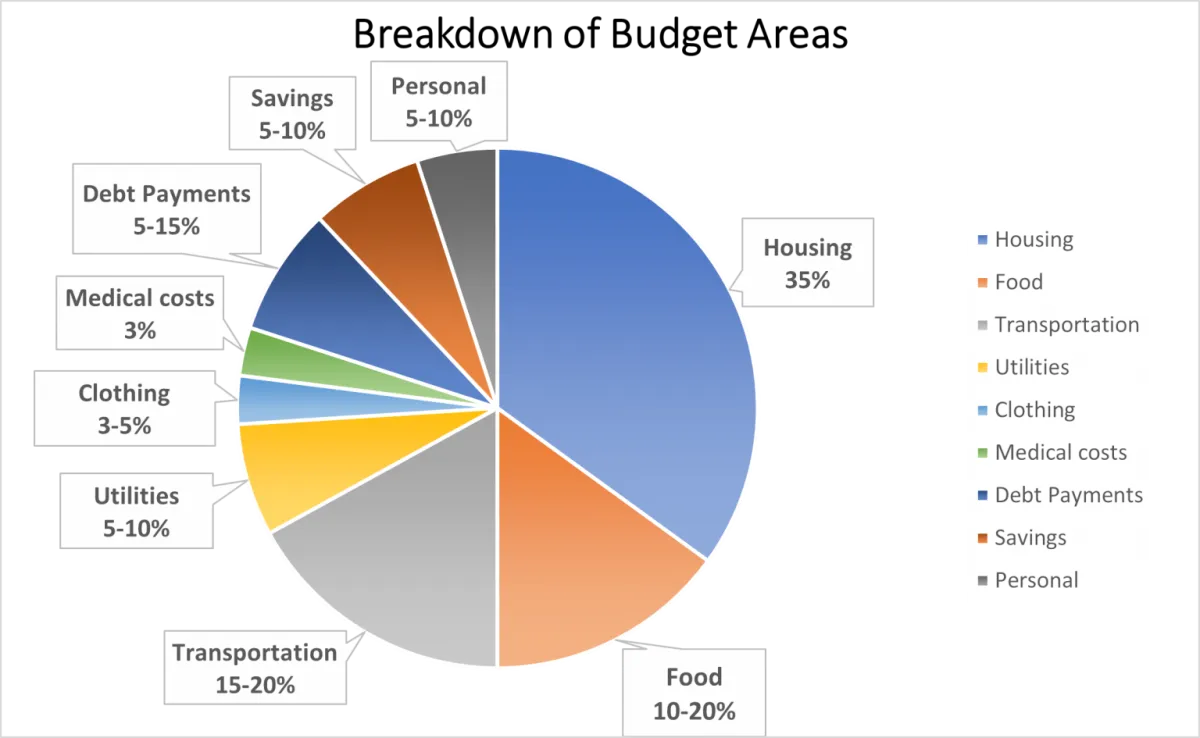

3. Create a realistic budget

Based on your income and expenses, create a budget that is realistic and sustainable. Allocate funds for necessities such as rent, utilities, and groceries, and set aside a portion for savings and discretionary spending. Be sure to differentiate between needs and wants to prioritize essential expenses.

4. Seek cost-saving opportunities

Take advantage of cost-saving opportunities to make your budget stretch further. Look for student discounts on public transportation, shopping, and entertainment. Consider buying used textbooks or borrowing them from the library rather than purchasing new ones. Cook meals at home instead of eating out frequently.

5. Monitor and adjust your budget

Regularly review your budget to track your progress and identify areas for improvement. Monitor your expenses to ensure they align with your budgeted amounts. If you notice overspending in certain categories, find ways to cut back and make adjustments accordingly.

6. Seek guidance and support

If you’re struggling with budgeting or managing your expenses, don’t hesitate to seek guidance. Many colleges and universities in Canada offer financial literacy workshops or counseling services to assist international students in managing their finances effectively. Take advantage of these resources to enhance your financial skills.

By creating a budget and managing your expenses wisely, you can ensure a financially secure and rewarding experience as an international student studying in Canada.

Exploring financial assistance options for international students

When it comes to studying abroad, one of the biggest concerns for international students is managing their finances. Budgeting plays a crucial role in ensuring a smooth and successful journey. As an international student in Canada, understanding the financial assistance options available to you is essential.

Scholarships and grants

Many Canadian universities and colleges offer scholarships and grants specifically for international students. These financial aid programs can help reduce the cost of tuition fees and living expenses. Be sure to research the scholarship opportunities provided by your chosen institution and submit your applications well in advance.

Work-study programs

Work-study programs provide international students with an opportunity to work part-time on campus while studying. These programs not only help cover expenses but also offer valuable work experience. Check with your institution about work-study options and eligibility criteria.

Government assistance

Some countries, including Canada, provide government assistance to international students. In Canada, you may be eligible for the Off-Campus Work Permit, which allows you to work off-campus for up to 20 hours per week during school terms and full-time during scheduled breaks. Additionally, there are provincial and territorial programs that offer financial aid to students in need. Research the specific requirements and application processes for these programs.

Private loans and grants

If you require additional financial support beyond scholarships and work-study options, you can explore private loans and grants. Banks, organizations, and foundations often offer loans and grants specifically for international students. Make sure to carefully review the terms and conditions before applying for any private funding.

Budgeting is vital to effectively manage your finances as an international student. By exploring these financial assistance options, you can ease the financial burden and focus on your studies and experience in Canada.

Planning for unexpected expenses and emergencies

In the midst of your financial planning as an international student in Canada, it is crucial to consider the potential impact of unexpected expenses and emergencies. Being prepared will help you maintain stability and avoid financial stress during challenging times. Here are some key steps to incorporate into your budgeting strategy:

1. Build an emergency fund

Set aside a portion of your income regularly to create an emergency fund. Aim to save at least three to six months’ worth of living expenses. This fund will serve as a safety net in case of unexpected events like medical emergencies, job loss, or unforeseen travel expenses.

2. Prioritize essential expenses

Identify your essential expenses, such as rent, utilities, and groceries. Make sure to allocate sufficient funds for these items first before considering other discretionary expenses. By prioritizing essentials, you ensure that your basic needs are covered even when facing unexpected financial challenges.

3. Research insurance options

Explore insurance options that suit your specific needs. Health insurance is usually mandatory for international students in Canada, but you may also consider other types of insurance like renter’s insurance or travel insurance. Insurance provides financial protection and can help mitigate the impact of unforeseen circumstances.

4. Create a contingency category in your budget

Allocate a small percentage of your budget for unexpected expenses. This contingency category will allow you to have some flexibility when unforeseen costs arise. By planning for the unexpected, you reduce the risk of breaking your budget when faced with emergencies.

5. Seek guidance from financial advisors

If you are unsure about managing unexpected expenses, consider seeking guidance from financial advisors. They can help assess your financial situation, offer personalized advice, and assist you in creating a comprehensive plan that accounts for emergencies.

In conclusion, while financial planning is vital for international students in Canada, it is equally important to plan for unexpected expenses and emergencies. By following these steps and maintaining financial preparedness, you can navigate unforeseen events with greater ease and minimize their impact on your overall financial stability.

Conclusion

In conclusion, international students in Canada must prioritize budgeting and financial planning to ensure a successful and stress-free academic journey. By setting realistic spending limits, tracking expenses, and exploring financial aid opportunities, students can effectively manage their finances and focus on their studies. Developing good financial habits during their time in Canada will not only benefit them during their studies but also in their future endeavors.