Building Credit: Using Travel to Improve Credit Score

Understanding the Relationship Between Travel and Credit Score

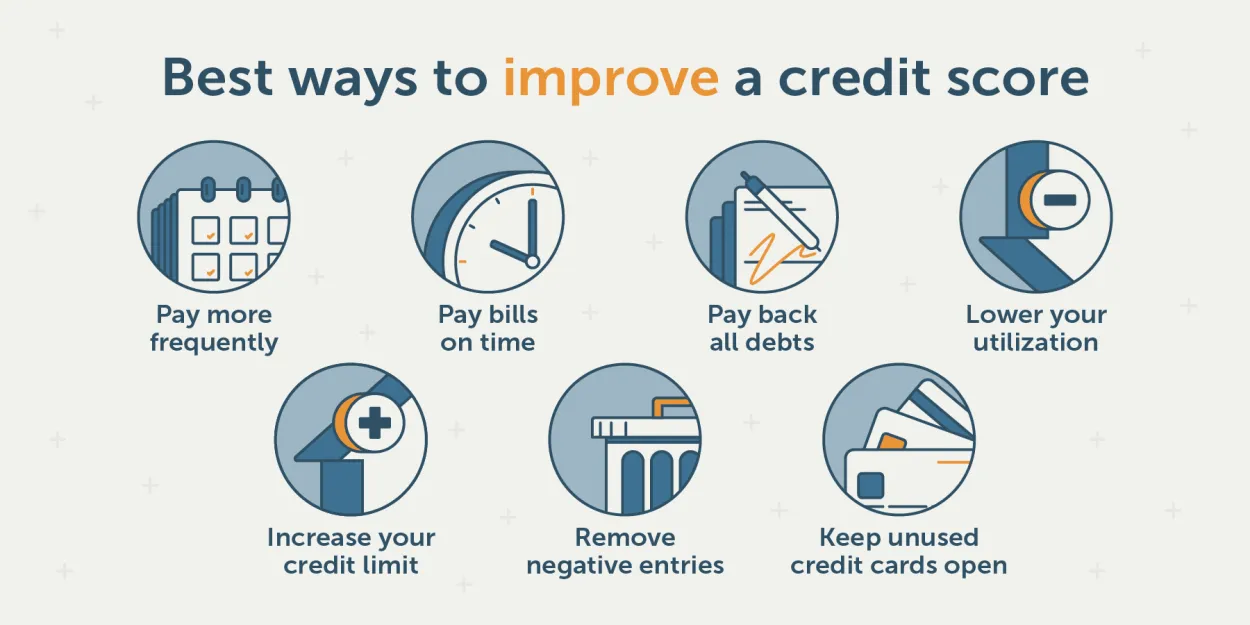

Traveling can have a significant impact on your credit score, and understanding this relationship is crucial for building and maintaining good credit. There are several ways in which travel can influence your credit score:

- Credit Card Usage: Using credit cards while traveling, especially for booking flights and hotels, can affect your credit utilization ratio. It is important to keep your credit utilization below 30% to maintain a healthy credit score.

- On-Time Payments: Making timely payments on your travel-related expenses, such as credit card bills and travel loans, demonstrates responsible financial behavior and positively impacts your credit score.

- Credit Inquiries: Applying for travel-related credit cards or loans may result in hard inquiries on your credit report. While one or two inquiries may have a minor impact, too many inquiries can lower your credit score.

- Reward Programs: Many travel credit cards offer rewards and loyalty programs. Taking advantage of these programs and earning rewards can enhance your credit score indirectly by increasing your available credit and improving your credit utilization ratio.

It is important to note that while travel can impact your credit score, it is only one factor among many. Building a strong credit history requires consistent responsible financial management, including paying bills on time, keeping credit utilization low, and avoiding excessive debt.

By understanding the relationship between travel and credit score, you can make informed decisions and use travel to your advantage in building and improving your credit score.

Using Credit Cards Responsibly While Traveling

When it comes to building credit, using your credit cards responsibly while traveling can be a game-changer. Not only can it help you improve your credit score, but it also offers numerous benefits during your trips. Here are some tips to maximize the impact of your credit card usage:

1. Choose the right credit card

Before embarking on your journey, make sure to select a credit card that aligns with your travel needs. Look for cards that offer rewards and benefits like airline miles, hotel points, or cashback for travel-related expenses.

2. Pay your bills on time

Timely payments are crucial for maintaining a good credit score. Be diligent about paying off your credit card bills before the due date, even while you’re away. You can set up automatic payments or use online banking to ensure you never miss a payment.

3. Keep your credit utilization low

Another vital aspect of using credit cards responsibly is to keep your credit utilization ratio low, ideally below 30%. This ratio represents how much of your available credit you’re utilizing. Keeping it low shows lenders that you can manage credit responsibly.

4. Monitor your transactions

While traveling, it’s essential to regularly monitor your credit card transactions to detect any unauthorized charges or suspicious activities. Report any discrepancies immediately to your credit card provider to protect yourself from fraud.

5. Minimize cash advances

Avoid using your credit card for cash advances as they usually come with high-interest rates and additional fees. Instead, withdraw cash from ATMs using a debit card to minimize extra charges.

6. Notify your credit card company

Before traveling, inform your credit card company about your plans to avoid any potential blocks or holds on your card due to suspicious activity outside of your usual spending patterns. This will ensure seamless usage during your trip.

7. Manage foreign transaction fees

Some credit cards charge foreign transaction fees for purchases made abroad. To avoid unnecessary fees, consider applying for a credit card that waives these charges or has a low fee structure for international transactions.

By using credit cards responsibly while traveling, you not only enhance your creditworthiness but also enjoy the convenience and benefits they offer. So, plan ahead, choose the right card, and make the most of your credit card usage during your travels!

Building Credit Through Travel Rewards Programs

In today’s competitive financial landscape, building a strong credit score is crucial for a variety of reasons. One innovative and exciting way to improve your credit score is by utilizing travel rewards programs. Not only can you enjoy amazing travel experiences, but you can also actively work towards enhancing your creditworthiness.

Travel rewards programs, offered by various credit card companies and airlines, allow you to earn points or miles for every dollar spent on eligible purchases. These points can then be redeemed for flights, hotel stays, car rentals, and more. By strategically using these programs, you can demonstrate responsible financial behavior and ultimately boost your credit score.

1. Consistent and Responsible Credit Card Usage

Using a travel rewards credit card for your everyday expenses and paying off the balance in full each month shows lenders that you are capable of managing credit responsibly. By consistently making on-time payments and keeping your credit utilization low, you can establish a positive credit history.

2. Utilizing Bonus Offers

Travel rewards programs often come with sign-up bonuses, which can provide a significant boost to your credit score. Taking advantage of these offers can help you rack up points quickly and efficiently. However, it’s important to review the terms and conditions, including any annual fees, to ensure the program aligns with your financial goals.

3. Diversifying Your Credit Mix

Participating in travel rewards programs allows you to diversify your credit mix. Lenders like to see a combination of different types of credit, such as credit cards, loans, and mortgages. By incorporating a travel rewards credit card into your credit portfolio, you can enhance your creditworthiness.

4. Monitoring Your Credit

As you actively engage in travel rewards programs, it’s crucial to monitor your credit regularly. This involves checking your credit reports for any discrepancies or errors that could potentially harm your score. By staying vigilant, you can address any issues promptly and ensure your credit profile remains strong.

In conclusion, building credit through travel rewards programs is an effective way to demonstrate responsible credit usage and improve your credit score. By utilizing these programs strategically, you can enjoy the perks of travel while working towards a brighter financial future.

Managing Finances for Better Credit Score

Building credit is an essential step towards financial stability. One effective way to improve your credit score is by strategically using travel. By following these tips, you can build and maintain a good credit score:

1. Use a Travel Credit Card

Consider obtaining a travel credit card that offers rewards and benefits. Use it for your travel expenses and make timely payments to demonstrate responsible credit usage.

2. Pay Off Your Balances

Avoid carrying credit card balances from month to month. Pay off your balances promptly to avoid interest charges and demonstrate responsible financial behavior.

3. Monitor Your Credit Report

Regularly check your credit report to ensure accuracy and identify any discrepancies. Address any inaccuracies promptly to maintain a healthy credit score.

4. Stay Within Your Budget

Traveling can be tempting and lead to overspending. Set a realistic travel budget and stick to it, ensuring you can comfortably pay off the expenses without impacting your credit score negatively.

5. Use Credit Wisely

Avoid excessive credit utilization. Aim to keep your credit card balances below 30% of your available credit limit. This demonstrates responsible credit management.

6. Make Timely Payments

Ensure you make timely payments for your travel-related expenses. Late payments can significantly impact your credit score negatively.

By managing your finances effectively and using travel wisely, you can improve your credit score over time. It’s important to note that building credit is a long-term process that requires discipline and responsible financial habits.

Conclusion

Utilizing travel as a strategy to build credit can be a smart and effective method. By responsibly managing credit cards, paying bills on time, and using travel rewards wisely, individuals can not only enjoy their trips but also improve their credit score. It’s a win-win scenario that allows for both financial growth and enjoyable travel experiences.